Insurify’s new ChatGPT app lets you get personalized car‑insurance quotes without leaving the chat. By typing a simple question, the tool pulls from a database of millions of quotes, compares carriers, and presents prices, coverage, and discounts in real time. It’s designed to turn a lengthy search into a quick conversation.

How the ChatGPT Insurance App Works

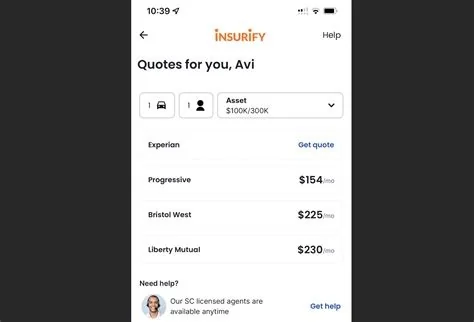

The app lives inside the ChatGPT interface, so you never need to open a separate website. When you ask something like “What’s the cheapest insurance for a 2018 Honda Civic in Austin?” the system taps Insurify’s proprietary quote engine, matches your vehicle, location, driver profile, and credit data, then returns a side‑by‑side comparison.

Natural‑Language Quote Requests

Unlike traditional forms that demand exact fields, the app understands plain‑language prompts. It extracts the make, model, year, and even your driving history from the conversation, then instantly generates estimates from more than 190 million stored quotes.

Seamless Transition to Purchase

If you decide to move forward, the conversation hands off to Insurify’s main platform where licensed agents finalize the policy. All the information you already provided stays in the system, so you won’t have to re‑enter details on a new page.

Why the Integration Matters for Drivers

Embedding the comparison engine in a tool you already use cuts the steps needed to shop for coverage. You can research, compare, and even start a purchase without juggling multiple tabs or remembering complex insurance jargon.

Cutting Friction in Car‑Insurance Shopping

- Speed: Get instant estimates in seconds.

- Clarity: See price, coverage limits, discounts, and customer‑service ratings side by side.

- Convenience: Stay inside the chat while you ask follow‑up questions.

Expanding Reach Across All 50 States

Insurify is licensed nationwide, so the app can generate quotes that comply with each state’s rating rules. This broad coverage means you can trust the numbers no matter where you live.

Industry Impact and Future Outlook

The launch signals a shift toward conversational AI as the front‑end for complex financial decisions. By proving that a dense data set can be accessed through simple dialogue, Insurify sets a template other fintech verticals may follow.

Potential for Other Financial Verticals

Mortgage, personal‑loan, and health‑plan providers could embed similar tools in chat platforms, letting you compare options while you’re already discussing your needs.

Regulatory and Privacy Considerations

Because the app handles sensitive data—driver’s license numbers, credit scores, and personal identifiers—Insurify must maintain strict compliance with state insurance regulations and enforce robust privacy safeguards. Ongoing monitoring will be essential to keep the service accurate and secure.