Japanese semiconductor and equipment makers are hitting limit‑up levels as earnings beat expectations and demand for high‑performance AI server chips accelerates. Investors are flocking to firms that supply the tools and components needed for AI‑driven data centers, creating a rapid price rally across the sector.

Key Drivers Behind the Limit‑Up Rally

Strong Earnings Boost Investor Confidence

Recent quarterly results from leading tool suppliers have exceeded internal forecasts, prompting a wave of buying pressure. The robust profit margins and upward‑revised guidance signal that the AI hardware market is expanding faster than anticipated, encouraging investors to increase exposure to these niche players.

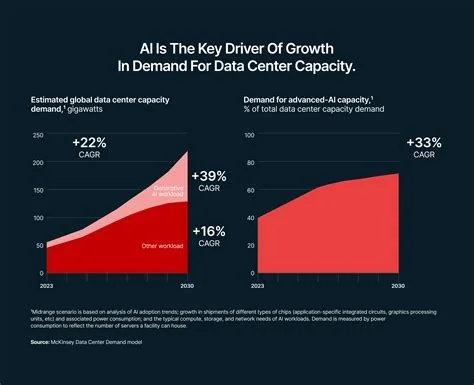

Growing Demand for AI Server Processors

Global AI workloads are driving a surge in orders for server‑grade processors and the specialized manufacturing equipment that supports them. Companies that produce wafer‑handling tools, such as electrostatic chucks, are experiencing renewed relevance as AI‑centric silicon production scales.

Impact on Japan’s AI Hardware Landscape

Emerging Opportunities for Niche Suppliers

The rally highlights a shift from traditional memory giants to smaller component makers and equipment providers. These firms are filling a gap in Japan’s AI ecosystem, offering investors a more direct play on the AI hardware boom.

Investor Considerations and Risks

While the upside appears compelling, the limit‑up phenomenon also introduces heightened volatility. Investors should weigh the sustainability of order inflows against the risk of short‑term earnings misses, and monitor how quickly companies can scale production to meet AI demand.

Outlook for the Next Earnings Season

The upcoming earnings cycle will test whether firms can maintain strong order books for AI‑focused server chips and related tooling. Companies that demonstrate consistent growth are likely to retain investor confidence, whereas those that fall short may see their shares retreat from current peak levels.