Japan’s generative‑AI app market is surging, with Google’s Gemini rapidly overtaking OpenAI’s ChatGPT in key categories while ChatGPT repositions itself as a “third‑OS” for everyday digital tasks. The shift is driving multi‑trillion‑yen revenues, prompting investors and developers to rethink how AI integrates with apps, devices, and user workflows. You’ll see new business models emerging as AI becomes the primary interface for many services.

Explosive Growth of Japan’s Generative‑AI App Market

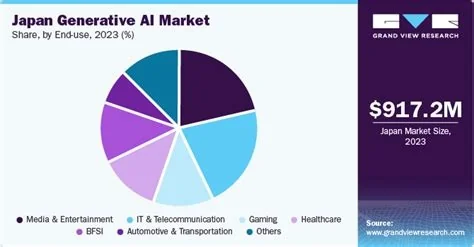

The AI software sector in Japan is projected to generate ¥1.8 trillion by 2030, reflecting a compound annual growth rate above 20%. Generative‑AI, which creates text, images, code, or audio on demand, is the fastest‑growing slice, outpacing other AI technologies worldwide. Japan’s mobile‑first culture and tech‑savvy users create a fertile environment for rapid adoption.

- AI software revenue expected to reach ¥1.8 trillion by 2030.

- Generative‑AI segment growing at a global CAGR of over 40%.

- Mobile‑centric ecosystem accelerates user uptake.

Gemini vs. ChatGPT: The Competitive Tug‑of‑War

Google’s Gemini entered the Japanese market with a bilingual model that handles Japanese and English fluently. Within months, its user base has expanded by double‑digit percentages, especially in creative‑writing and image‑generation tools. Meanwhile, OpenAI is positioning ChatGPT as a “third‑OS,” a platform‑level interface that sits alongside traditional operating systems, allowing users to launch apps, retrieve data, and automate tasks through natural language.

Gemini’s Local Advantage

Gemini’s localized training gives it an edge in understanding cultural nuances and regional slang, which translates into higher engagement rates for Japanese users. Developers report faster adoption curves for Gemini‑powered features in marketing and design apps.

ChatGPT’s Third‑OS Strategy

ChatGPT’s vision of a “third‑OS” aims to embed AI directly into Android, iOS, and emerging wearables. This approach could reduce the need for separate app installations, letting you interact with services via voice or text alone. The strategy is designed to lock in a larger share of Japan’s mobile‑first audience.

Financial Stakes Highlighted by Major Investors

Investors are already feeling the impact. A leading telecom conglomerate posted a record nine‑month net profit, largely thanks to its stake in OpenAI. The investment contributed over ¥300 billion to earnings, underscoring how generative‑AI is becoming a core profit driver for large corporations.

Government Support and Talent Landscape

The Japanese government backs the AI surge with a multi‑trillion‑yen strategy budget that funds R&D, public‑sector pilots, and industry collaborations. Despite this, a talent gap remains: roughly 50,000 AI professionals are available, far short of the 150,000 needed to sustain long‑term growth.

Implications for Developers and Users

If Gemini continues to chip away at ChatGPT’s market share, you’ll need to design cross‑model compatibility from day one, ensuring your apps work seamlessly on either platform. For end users, the “third‑OS” promise could mean fewer app downloads and more voice‑ or text‑driven interactions, blurring the line between operating system and application. If you’re a developer, consider building flexible APIs that can switch between Gemini and ChatGPT to stay ahead of shifting user preferences.