Twenty AI‑focused startups have collectively secured more than $440 million in fresh capital this month, highlighting a rapid acceleration of investor interest across healthcare, fintech, and emerging markets. The funding wave underscores confidence in AI‑driven solutions, with notable deals ranging from a $250 million round that pushes a health‑AI firm to a $12 billion valuation to a $191 million surge among Indian AI companies.

OpenEvidence Doubles Valuation with $250M Round

OpenEvidence, a U.S. medical‑AI startup that assists physicians with clinical decision‑making, announced a $250 million funding round that lifted its post‑money valuation to $12 billion, effectively doubling its worth from the previous round. The round was led by existing backers and reflects growing confidence in AI tools that improve diagnostic accuracy and workflow efficiency in healthcare.

Indian AI Startups Raise $191M in One Week

In a single week, Indian AI companies secured $191 million across 27 deals, covering AI‑enabled fintech, agritech, and enterprise automation. The rapid influx of capital demonstrates that investors are eager to back technology ready for scale in a market with large, data‑rich populations, expanding AI innovation beyond traditional hubs.

Broader Investment Climate Fuels AI Growth

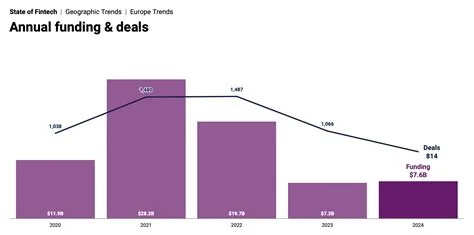

The AI funding surge aligns with strong capital flows into adjacent frontier technologies. Over $7 billion has been deployed in Web3 projects, while alternative‑payments startups have attracted $418 million, many of which integrate machine‑learning models for fraud detection, credit scoring, and personalized experiences. This macro‑level willingness to fund high‑risk innovation creates a supportive environment for AI ventures.

Key Takeaways for the AI Sector

- Healthcare AI scales rapidly – The valuation jump of OpenEvidence illustrates that investors view AI‑enabled clinical tools as commercially viable and capable of delivering measurable cost savings and improved patient outcomes.

- Emerging markets gain traction – The Indian funding round shows that AI innovation is no longer confined to traditional tech hubs, with capital flowing to regions where large, data‑rich populations present unique AI use cases.

- Cross‑technology synergies emerge – Growth in Web3 and alternative‑payments funding suggests AI startups may increasingly partner with blockchain and fintech firms to create integrated solutions such as AI‑driven smart contracts and real‑time risk analytics for digital payments.

Investor Outlook and Next Steps

Established venture firms continue to back AI startups, signaling belief in long‑term revenue potential. While some analysts caution about a possible soft landing in valuations, the current cadence of large rounds provides runway for expanding engineering teams, accelerating product development, and securing regulatory clearances—especially critical for health‑tech solutions. In India, the capital influx is expected to boost AI research hiring and deepen partnerships with large enterprises seeking intelligent upgrades.

Conclusion

The twenty AI companies that secured new investment this month illustrate a maturing sector with diversified, global funding sources. From a $12 billion valuation for a single health‑AI firm to a week‑long $191 million surge in Indian deals, the landscape points to sustained capital support for AI intersecting with healthcare, finance, and emerging blockchain ecosystems, provided startups can turn algorithmic promise into scalable revenue.