The AI boom has turned high‑bandwidth memory into a $600 billion market, and Samsung and SK Hynix now control the vast majority of that pie. Their combined dominance shapes everything from data‑center GPUs to custom ASICs, leaving designers and startups scrambling for limited HBM supply. Here’s what the duopoly means for you and the tech ecosystem.

Why AI Drives a $600B Memory Surge

Artificial‑intelligence models demand bandwidth that traditional DRAM simply can’t provide. As neural nets grow larger, data‑center operators prioritize HBM to keep training times low, which squeezes supply and pushes prices upward. The result is a tight market where every extra gigabyte of bandwidth translates into a competitive edge, and you’ll feel that pressure in every hardware budget.

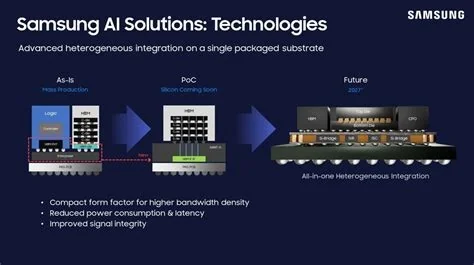

How Samsung and SK Hynix Built Their Lead

For decades Samsung has ruled the DRAM and NAND space, leveraging massive scale and deep vertical integration. SK Hynix, meanwhile, bet early on high‑bandwidth memory, investing heavily in multi‑layer stack technology. Their relentless R&D and capacity expansions have turned both companies into the go‑to sources for the most advanced HBM chips used by the world’s biggest AI players.

Key Product Offerings

- Samsung – 8‑layer and 12‑layer HBM stacks that power leading GPUs.

- SK Hynix – 16‑layer HBM solutions favored by large‑scale training clusters.

Implications for Chip Designers and Startups

The duopoly simplifies supplier negotiations—you know exactly who to contact for capacity forecasts. But it also creates a single‑point‑failure risk; any fab disruption could stall AI training pipelines worldwide. Startups are feeling the pinch, prompting many to explore alternative memory architectures or to redesign workloads around the limited HBM they can secure.

Strategies to Mitigate Risk

- Qualify both vendors for a dual‑source supply chain.

- Investigate on‑chip SRAM or emerging MRAM as fallback options.

- Plan for longer lead times and higher component costs in your budgeting.

Future Outlook for the AI Memory Landscape

Given the massive capital required to match Samsung and SK Hynix, new entrants will struggle to break the duopoly anytime soon. Expect continued consolidation, with smaller memory firms seeking partnerships or acquisition offers to stay relevant. Still, a breakthrough technology or a shift in AI architecture could eventually open the market to fresh competition.

What You Should Do Now

Secure HBM early by locking in dual‑source agreements, and keep an eye on emerging memory technologies that might offer a cost‑effective alternative. Adjust your product roadmaps to account for higher pricing, and stay agile—your ability to adapt will determine whether you thrive in this Korean‑dominated AI memory era.