Polystrat is an autonomous AI trading agent built for Polymarket that lets you set high‑level goals in plain English and then watches the markets, rebalances positions, and executes trades around the clock. It runs from a self‑custodial safe account, so you keep full control of your funds while the AI does the heavy lifting.

How Polystrat Automates Polymarket Trading

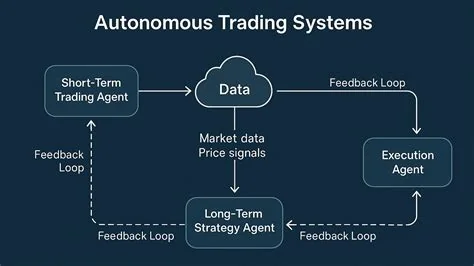

Polystrat reads news, weighs probabilities, and acts on opportunities without waiting for manual input. You simply define what you want to achieve—like targeting a specific profit range or focusing on political events—and the agent handles the rest, from data ingestion to order placement.

Self‑Custodial Safe Accounts

The agent lives inside a safe account on the Pearl app, meaning your assets never leave your wallet. This design gives you peace of mind while still allowing the AI to move funds as needed for trades.

24/7 Market Scouting and Rebalancing

Because the AI never sleeps, it can spot emerging trends in sports, economics, or social sentiment at any hour. It continuously evaluates positions and rebalances them to stay aligned with your objectives.

Open‑Source Frameworks Powering AI Traders

Developers can tap into a modular, open‑source framework that stitches together market data connectors, news ingestion pipelines, vector databases for context, LLM‑powered reasoning layers, and automated execution logic. This stack abstracts away raw API complexity, letting you turn a language model into a market‑making machine with just a few lines of code.

Modular Architecture for Rapid Deployment

The framework’s plug‑and‑play components let you swap in a new LLM or add a fresh data source without rewriting the whole system. That flexibility dramatically shortens the time from prototype to live deployment.

Arbitrage Bots in Action

One community‑built bot automatically detects risk‑free price discrepancies across Polymarket contracts and executes trades in real time. While it follows a rule‑based strategy—spot the spread, lock it in—it shows how AI can automate profit‑seeking behavior at scale.

Attention Markets Expand Prediction Horizons

Polymarket is partnering with Kaito AI to launch “attention markets,” a product line that lets you bet on social‑media mindshare and public sentiment trends. By quantifying collective attention, these markets turn online buzz into tradable assets, opening a new frontier beyond traditional binary events.

Implications for Traders

- Lowered entry barriers – You can start trading without a finance PhD.

- Shift to reasoning agents – AI evaluates multi‑source data, not just price spikes.

- New asset class: attention – Betting on social‑media trends adds fresh opportunities.

- Regulatory and security considerations – Self‑custodial accounts keep control, but autonomous execution raises accountability questions.

Practitioner Perspective

David Minarsch, co‑founder of Olas, says Polystrat “is designed to give prediction markets a real sense of scale.” He emphasizes that the agent abstracts data collection and execution, allowing retail traders to engage around the clock without constant manual oversight. A developer involved in the open‑source framework adds that the modular design “makes it possible to plug in a new LLM or a fresh data source with just a few lines of code,” slashing development time.

Looking Ahead

If AI agents can reliably parse news, gauge sentiment, and spot arbitrage, the edge of human‑only traders may shrink quickly. The blend of autonomous agents and attention markets could turn Polymarket into a real‑time barometer for both factual events and the collective psyche. The choice is yours: let the AI trade for you, or stay in the driver’s seat.