OpenClaw AI lets anyone spin up autonomous agents on blockchains, turning complex trading strategies into weekend projects. Its open‑source, plug‑and‑play design has pushed the platform from a niche experiment to a market‑shaping force, with millions of bots now handling trades, token management, and on‑chain economies. If you’re looking to automate crypto operations, OpenClaw is the tool that’s redefining speed and accessibility.

Why OpenClaw AI Is Gaining Traction

The framework abstracts away the heavy lifting of blockchain interaction, so developers can focus on strategy instead of infrastructure. By offering ready‑made modules for wallet handling, trade execution, and token issuance, it lowers the entry barrier and invites both hobbyists and professional desks to experiment.

Key Features That Attract Traders

- Plug‑and‑play deployment – you can launch an agent in hours rather than weeks.

- Autonomous market scanning – bots analyze odds and price discrepancies faster than any human.

- Token lifecycle management – agents can mint, stake, and rebalance assets without manual intervention.

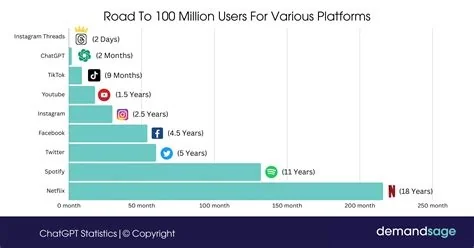

Rapid Adoption Numbers

Recent metrics show the ecosystem has surpassed 1.5 million active agents, many of which have formed self‑sustaining on‑chain communities. This scale signals a shift from human‑centric execution to machine‑native financial behavior across DeFi platforms.

Risks and Security Concerns

While accessibility fuels growth, it also opens doors to security and stability challenges. Exposed API keys can become theft vectors, and uncontrolled bots may trigger flash‑crash scenarios that destabilize markets.

- Unprotected API keys are vulnerable to theft.

- Rogue agents can amplify price swings.

- Regulatory frameworks have yet to catch up with autonomous trading.

Impact on Crypto Markets

Autonomous arbitrage bots are tightening price gaps on prediction markets, leading to deeper liquidity and more efficient pricing. At the same time, the proliferation of bots raises questions about market manipulation and the adequacy of existing surveillance mechanisms.

Best Practices for Using OpenClaw AI

To harness the power of OpenClaw without exposing yourself to unnecessary risk, follow these guidelines:

- Secure your API keys with hardware wallets or encrypted storage.

- Monitor agent activity in real time and set automated alerts.

- Start in a sandbox environment before deploying to live markets.

Future Outlook

The next chapter will likely hinge on how quickly governance protocols evolve to manage autonomous agents. As developers experiment with coordination mechanisms, we may see digital economies where bots negotiate, pool resources, and even self‑govern on‑chain—provided the community builds robust safeguards.