NVIDIA is gearing up to release its fiscal Q4 earnings, and investors are watching closely to see how the AI‑focused product lineup translates into profit. Expect a strong data‑center contribution, while gaming revenue may play a smaller role. If the numbers meet market hopes, you could see a boost in AI‑related stocks across the board.

What Analysts Anticipate from NVIDIA’s Q4 Results

Analysts expect double‑digit growth in the AI segment, driven by the latest H100 and upcoming Hopper‑based accelerators. The data‑center business is projected to outpace traditional gaming revenue, signaling a shift toward AI‑first computing. You’ll want to monitor the earnings call for guidance on future product roadmaps.

Key AI‑Centric Revenue Drivers

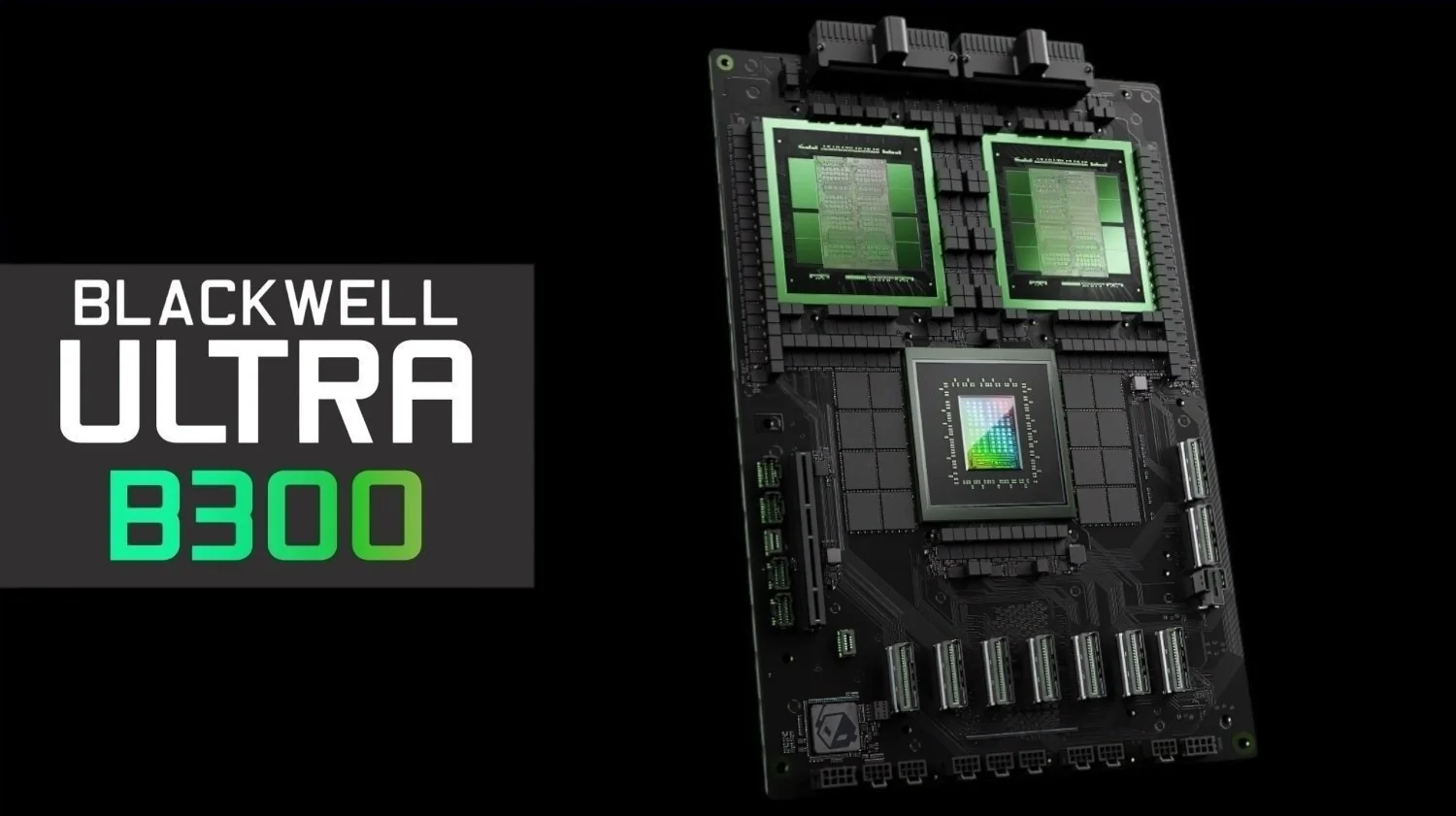

- H100 GPUs – powering large‑language models and high‑performance computing workloads.

- Hopper accelerators – set to boost inference efficiency for cloud providers.

- Data‑center services – expanding partnerships with major cloud platforms.

Impact on the Broader Tech Ecosystem

The ripple effect of a strong earnings report could lift downstream players, from edge‑computing startups to major cloud vendors. A positive surprise may reinforce confidence in AI‑centric business models, prompting investors to allocate more capital toward firms that rely on NVIDIA hardware.

Practitioner Insight on NVIDIA’s Hardware Performance

From a developer’s perspective, the latest GPUs have shaved weeks off model training cycles. When earnings reflect that demand, it validates the industry’s move toward specialized AI hardware, accelerating research timelines and product development.

Takeaway for Investors

Keep an eye on the split between data‑center and gaming revenue. A solid performance in the AI segment could signal sustained momentum, while any weakness in gaming may be offset by rapid adoption of new accelerators. Stay ready to adjust your portfolio based on the detailed breakdown released after the earnings call.