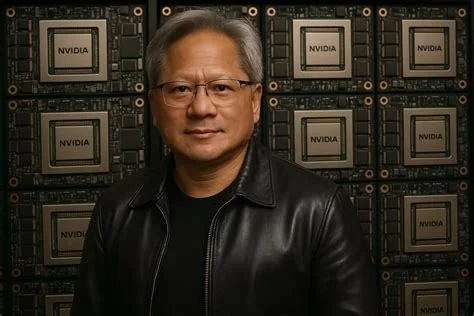

In a surprise turn, Nvidia’s CEO Jensen Huang clarified that the much‑talked‑about $100 billion pledge to OpenAI was never a binding commitment. The clarification came after months of speculation, and it reshapes expectations for both companies’ future collaborations and the broader AI hardware market.

Background of the Nvidia‑OpenAI Deal

Back in September, Nvidia and OpenAI released a joint letter of intent that hinted at an “up to $100 billion” infusion to power OpenAI’s next‑generation models. The announcement described a plan to deploy ten gigawatts of Nvidia hardware—an amount comparable to the output of ten nuclear reactors. At the time, analysts interpreted the figure as a potential record‑size investment, even though the document was explicitly labeled a non‑binding letter of intent.

Letter of Intent vs. Binding Contract

The September filing made it clear that the parties were still negotiating terms. While the language “up to $100 billion” left room for interpretation, it never constituted a legal obligation. This nuance mattered because investors and media outlets amplified the headline number without emphasizing the provisional nature of the agreement.

Why the $100 B Figure Wasn’t a Commitment

During a recent press briefing in Taiwan, Huang was asked directly whether Nvidia would write a $100 billion check. He responded, “No, no, nothing like that,” and added that Nvidia would “invest one step at a time.” The CEO emphasized that the company remains a “large investor” in OpenAI’s upcoming funding round, but he stopped short of confirming any specific dollar amount.

Technical Friction Over Inference Performance

Sources close to OpenAI indicate that the startup has encountered performance bottlenecks with certain Nvidia GPUs during inference workloads, especially in code‑generation tools. Those latency concerns have prompted OpenAI to explore alternative hardware options, which may have contributed to the slowdown in finalizing the massive investment.

Market Impact and Investor Sentiment

Following Huang’s clarification, Nvidia’s shares slipped about 1.1 percent, reflecting investor unease about the missing cash infusion. Some analysts warn that the episode could temper enthusiasm for future “mega‑deal” headlines, reminding the market that non‑binding LOIs can be volatile.

Practitioner Perspective

“From a data‑center operations standpoint, the hardware choice is driven by real‑world performance metrics, not headline numbers,” says Maya Patel, senior systems architect at a major cloud provider. “If OpenAI is seeing latency issues with certain GPUs for inference, you’ll see that ripple through our own capacity planning. It doesn’t mean Nvidia’s chips are inferior, but it does mean the ecosystem needs transparent roadmaps and consistent performance across both training and inference.”

What’s Next for Nvidia and OpenAI?

The key question now is whether the two companies can bridge the technical gaps and revive a partnership that lives up to the original hype. If they succeed, demand for high‑performance AI chips will likely surge as more startups chase the compute horsepower needed for next‑gen models. If the partnership stalls, competitors such as Google’s TPU division or emerging ASIC players could capture a larger slice of the inference market that Nvidia hoped to dominate.

- Expect a phased investment approach rather than a single massive cash injection.

- Watch for performance‑focused updates from Nvidia that address inference latency.

- Monitor how alternative hardware vendors position themselves as viable options for AI startups.