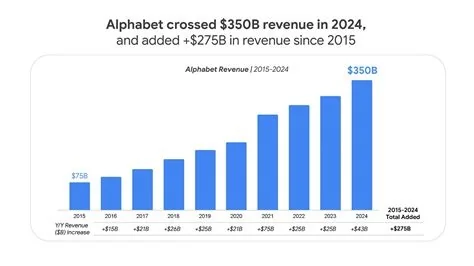

Alphabet just issued a 100‑year bond worth about 5 trillion yen to fund its AI push, marking the longest‑dated debt ever by a U.S. tech firm. The sale gives the company a cheap, century‑long financing runway while signaling that investors trust its cash flow. If you’re watching tech finance, this move reshapes how AI projects get capital.

Why Alphabet Chose a 100‑Year Bond

The AI race demands massive, upfront spending on data centers, custom silicon, and next‑generation software. Traditional cash reserves and short‑term equity raises can’t keep up with the scale of those investments. By locking in financing for a full century, Alphabet can spread the cost of today’s massive build‑out over many future earnings cycles.

Key Benefits of Ultra‑Long Debt

- Rate Certainty: The company secures a fixed financing cost now, shielding itself from potential rate hikes.

- Investor Confidence: Institutional investors are willing to commit capital for a hundred years, reflecting trust in Alphabet’s brand and cash‑generation power.

- Balance‑Sheet Flexibility: A long‑dated note frees up short‑term borrowing capacity for other strategic moves.

How the Bond Works

The 100‑year note carries a coupon that reflects the premium investors demand for such a long horizon. While the exact rate isn’t public, it’s expected to sit above typical 10‑year Treasury yields, compensating buyers for the extended risk.

Interest and Investor Appeal

Investors see the bond as a way to diversify into a stable, high‑quality issuer with predictable cash flows. The coupon payments provide a steady income stream, and the sheer length of the instrument creates a unique niche in the yield curve that few other securities can match.

Implications for the Tech Sector

Alphabet’s move normalizes the idea that AI is a capital‑heavy engine, not just a software upgrade. Other tech giants may now consider similar ultra‑long financing to lock in cheap rates before market conditions shift.

Potential Ripple Effects

- Companies like Microsoft, Amazon, and Meta could explore century‑long bonds to fund their own AI infrastructure.

- The issuance adds a new benchmark to the ultra‑long end of the yield curve, encouraging more issuers to tap this space.

- Investors seeking long‑duration assets may shift more capital toward corporate bonds, reshaping demand dynamics across markets.

What This Means for You

If you’re an investor, the bond offers a rare chance to earn a premium yield from a financially robust tech leader. For business leaders, it signals that securing long‑term financing can be a strategic advantage when pursuing massive, forward‑looking projects. Keep an eye on how other firms respond—your next investment or financing decision could be directly influenced by Alphabet’s bold 100‑year bet.