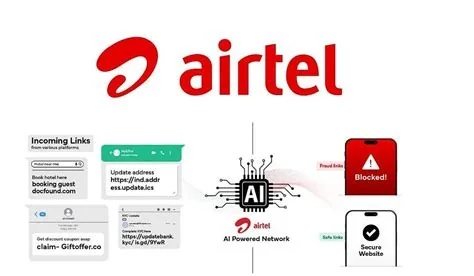

Airtel’s new Fraud Alert uses AI to monitor every call on its network, spotting spoken one‑time passwords and warning users before scammers can exploit them. The system can even cut the call in real time, giving you a built‑in shield against OTP‑based fraud without needing extra apps. It works on 4G and 5G for post‑paid and prepaid users, acting the moment the OTP is spoken.

How Airtel’s Fraud Alert Works

The feature sits at the network layer, giving Airtel a bird’s‑eye view of call patterns across its entire subscriber base. When a conversation matches fraud indicators—such as a sudden request for an OTP—the AI engine flags the call and triggers an immediate alert.

Network‑Level AI Detection

Unlike handset‑based solutions, the AI analyzes voice cues, call duration, and the timing of OTP generation directly in the carrier’s infrastructure. This lets the system intervene before the code is even entered, cutting the fraud loop at its source.

Real‑Time User Alerts

Subscribers receive an on‑screen pop‑up or a voice prompt that says, “Do not share this OTP – it may be a fraud attempt.” The alert appears while the call is still active, giving you a chance to hang up before any damage occurs.

Why Network‑Level Protection Beats App‑Based Tools

App‑level alerts can only react after the OTP has been typed, leaving a vulnerable window for attackers. Airtel’s network‑level approach blocks the threat in real time, eliminating the need for users to install additional security apps and reducing friction in everyday phone use.

Impact on Users and the Telecom Ecosystem

Benefits for Consumers

Customers enjoy a seamless security layer that works automatically on every call. By removing the reliance on third‑party apps, the solution makes protection accessible to anyone with an Airtel line, whether they’re on a budget prepaid plan or a premium post‑paid package.

Advantages for Banks and Fintechs

Financial institutions can rely on Airtel’s carrier‑embedded AI as an additional line of defense, potentially lowering the cost of fraud mitigation. The real‑time alerts complement existing banking security measures, creating a stronger overall shield against social‑engineering attacks.

Future Enhancements

Airtel plans to keep the AI models up to date with continuous learning, adding new fraud patterns as they emerge. Upcoming extensions may include detection of phishing URLs in SMS and flagging of suspicious USSD sessions.

- Enhanced voice‑pattern analysis

- SMS phishing detection

- USSD session monitoring

With Fraud Alert in place, you’ll no longer have to wonder whether a stranger on the line is trying to steal your OTP. The answer is clear: say “no” to sharing that code, and let Airtel’s AI do the heavy lifting.