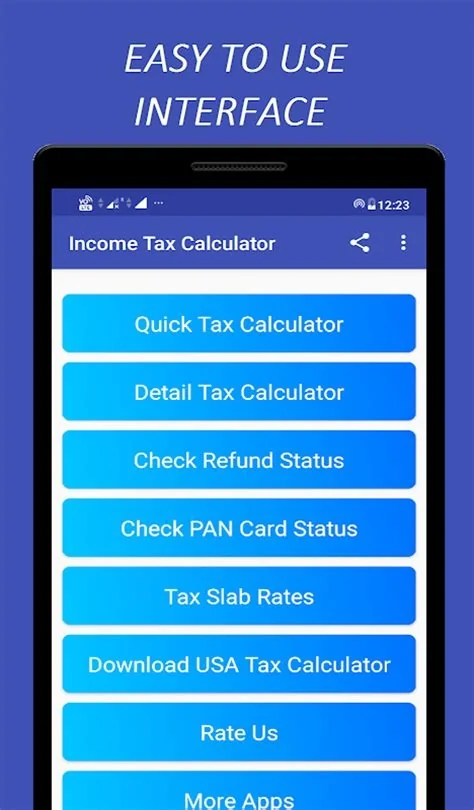

Free tax calculators now pull the latest 2025 tax tables, apply current deductions and credits, and let you input age, filing status, and income in seconds. They estimate federal, state, and even Canadian liabilities, simulate withholding changes, and provide a quick refund or bill projection. This means you can see a realistic tax picture early and adjust your finances before filing.

Why the New Tools Matter

The IRS recently updated brackets and introduced expanded credits, prompting developers to refresh their calculators. By reflecting these legislative changes, the tools give you a more accurate snapshot of what you’ll owe or receive.

Key Technical Improvements

- Official Tax Tables: Direct integration with the latest 2025 rates ensures estimates match government data.

- Dynamic Logic: Conditional calculations mimic the IRS formula—gross income, adjustments, deductions, then credits.

- Withholding Simulation: Adjust W‑4 allowances and see potential refund swings instantly.

- Cross‑Border Support: Options for both U.S. federal/state and Canadian federal calculations.

- Zero Cost: All features are available for free in any modern browser.

Benefits for Taxpayers

Using a free calculator can help you avoid underpayment penalties by spotting withholding gaps early. You can also experiment with “what‑if” scenarios, like adding a retirement contribution, to see how they affect your refund.

Practical Steps You Can Take

- Enter your latest pay stub and see the projected refund or bill.

- If the estimate shows a large refund, consider directing that money into a savings or investment vehicle.

- If a tax bill appears, adjust your W‑4 or plan quarterly estimated payments.

- For complex situations—multiple income streams or high net worth—consult a CPA for a detailed review.

Limitations to Keep in Mind

While free calculators give a solid ballpark figure, they simplify many nuances. State‑specific taxes, local district levies, and unique credits may not be captured. They’re great for quick checks but aren’t a substitute for professional advice when your tax situation is intricate.

Bottom Line

The surge of up‑to‑date, free tax calculators is a welcome upgrade for anyone looking to demystify their 2025 tax outlook. They’re not perfect, but they provide a fast, cost‑free first step that can save you time, money, and late‑night spreadsheet stress.