The KOSPI surged past the 5,000‑point mark as AI‑driven demand for high‑performance memory chips propelled Samsung Electronics and SK Hynix to new highs, turning South Korea’s stock market into a leading beneficiary of the global artificial‑intelligence surge.

AI‑Driven Memory Chip Surge Fuels KOSPI Rally

The index climbed more than 2% in a single session, closing near 4,953 points after a brief peak above 5,019. This rapid advance reflects the outsized influence of semiconductor leaders, which together account for a significant share of market capitalization.

Key Drivers Behind the Surge

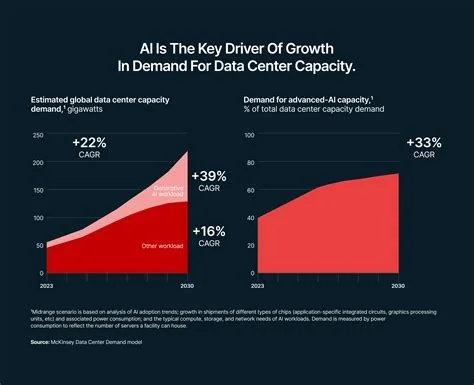

- AI workloads: Generative‑AI models require massive bandwidth, boosting demand for DRAM and NAND flash.

- Supply expansion: Samsung and SK Hynix have accelerated capacity upgrades to meet global data‑center needs.

- Investor sentiment: Market participants view the memory‑chip supercycle as a long‑term growth engine.

Why Memory Chips Are Critical in the AI Era

High‑capacity, low‑latency memory is essential for training and inference in AI systems. As data‑center operators scale up AI services, they prioritize the fastest DRAM and NAND solutions, cementing South Korea’s position as a core supplier in the global supply chain.

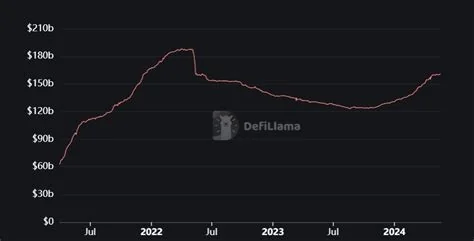

Price Dynamics and Impact on Consumer Electronics

Rising memory‑chip prices are compressing margins for smartphone, laptop, and TV manufacturers that rely on affordable components. Some OEMs are delaying product launches or seeking alternative suppliers, adding uncertainty to the broader technology sector.

Market Volatility Risks and Concentration Concerns

The rally’s concentration in a few semiconductor stocks heightens volatility. Should AI demand plateau or inventory levels rise, the same companies driving the upside could become sources of downside pressure, potentially triggering broader market corrections.

Policy Implications and Strategic Outlook

Government incentives that supported semiconductor R&D and capacity expansion have paid off, but policymakers must balance these benefits with measures to ease supply‑chain strain on downstream manufacturers. Diversifying the tech export basket and encouraging domestic AI‑enabled product consumption are key strategic moves.

Future Outlook for AI‑Powered Semiconductor Growth

Continued AI adoption is expected to sustain robust memory‑chip demand, preserving the valuation premium for Samsung and SK Hynix. However, investors should monitor price trends, inventory balances, and capital‑expenditure plans closely to gauge whether the current rally represents a durable shift or a temporary spike within a volatile supercycle.