OpenAI is facing an estimated $14 billion loss in 2026, driven by soaring infrastructure and compute costs and a new advertising program within ChatGPT. The deficit threatens the platform’s viability, prompting urgent scrutiny of its revenue model, funding needs, and competitive position in the fast‑evolving AI market.

Mounting Deficit and Its Drivers

Infrastructure and Compute Expenses

The primary source of the projected shortfall is the rapid expansion of cloud infrastructure required to train increasingly large language models. Compute‑intensive development, data‑center scaling, and ongoing research hiring have outpaced revenue growth, creating a cash‑burn cycle that jeopardizes long‑term sustainability.

Advertising Rollout as a Revenue Buffer

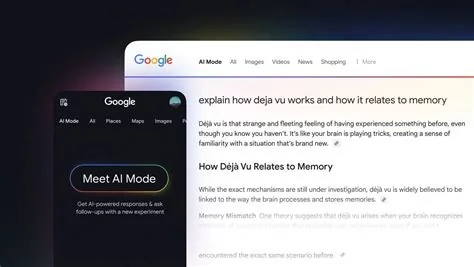

To counterbalance the cash drain, OpenAI has introduced advertisements for both free‑tier and “Go” (formerly “ChatGPT Plus”) users. This marks a strategic shift from a subscription‑only model to a hybrid approach, aiming to generate immediate income while the company continues to invest heavily in AI research.

Legal and Competitive Pressures

Internal Alerts and Market Competition

Internal communications have highlighted a heightened sense of urgency as rivals accelerate their own AI offerings. The emergence of competing models intensifies the need for continuous investment, further straining OpenAI’s financial resources.

Litigation and Funding Challenges

Ongoing legal disputes add another layer of complexity, diverting management attention and consuming financial resources that could otherwise support core development initiatives.

Background on ChatGPT’s Growth

Since its 2022 launch, ChatGPT has become a flagship AI product, attracting millions of users and securing multi‑billion‑dollar partnerships. Historically, revenue stemmed from subscription fees and licensing deals, but the recent ad integration represents the first major diversification of its monetization strategy.

Implications for the AI Ecosystem

If the deficit materializes, OpenAI may need to scale back research, delay new model releases, or seek additional external capital. Competitors could capitalize on any slowdown, potentially reshaping market dynamics and influencing user expectations around ad‑supported AI services.

Outlook and Future Scenarios

Analysts will monitor OpenAI’s next moves closely—whether it secures fresh funding, renegotiates strategic partnerships, or refines its advertising approach. The company’s ability to stabilize finances before the projected loss window closes will determine the future trajectory of one of the AI industry’s most influential platforms.