NFRA, India’s statutory audit regulator, is integrating artificial intelligence into its oversight by inspecting ten audit firms this financial year and launching a ₹1.5 crore AI challenge to develop compliance solutions. The dual effort aims to accelerate audit quality monitoring, reduce manual workload, and create scalable AI tools for future regulatory use.

AI Pilot “Baby Steps” for Audit Supervision

Objectives of the AI Pilot

The regulator is piloting AI‑driven analytics on a limited set of audit engagements. The focus is on machine‑learning models that flag anomalies, assess compliance with Indian Accounting Standards, and detect patterns indicating potential audit quality lapses. The pilot will inform how AI can be scaled across the entire inspection regime.

₹1.5 Cr AI Challenge to Boost Compliance Solutions

Challenge Goals

NFRA invites startups, research institutions, and technology firms to create AI tools that enhance financial reporting compliance. The competition offers a prize pool of ₹1.5 crore and seeks solutions that can:

- Automate extraction and validation of financial data from statements.

- Apply natural‑language processing to interpret disclosures and footnotes.

- Generate risk scores for audit firms based on historical performance and regulatory breaches.

NFRA’s Expanding Oversight Mandate

Established under the Companies Act, NFRA oversees statutory audit quality, enforces accounting standards, and takes action against non‑compliant audit firms. Its inspection count has risen steadily each fiscal year, reflecting a broader governmental push to strengthen corporate governance.

Potential Implications for the Audit Ecosystem

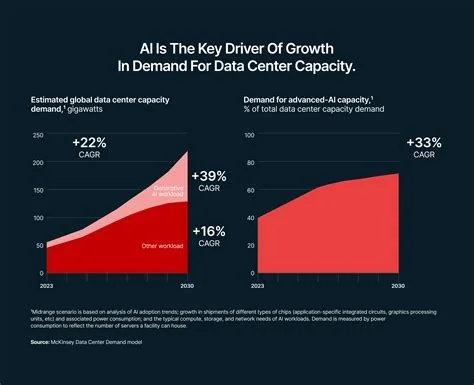

Speed and Scalability

Automated data analysis can reduce the time auditors and regulators spend on manual checks, allowing NFRA to cover more firms within the same resource envelope.

Predictive Risk Assessment

Machine‑learning models trained on historical inspection outcomes could flag high‑risk firms before a full‑scale audit, enabling targeted interventions.

Transparency and Consistency

Standardised AI‑driven metrics may reduce subjectivity in inspection findings, fostering greater confidence among listed companies and investors.

Industry Reaction to the AI Initiative

Fintech incubators and university research labs have shown strong interest, viewing the challenge as a fast‑track to market for compliance‑focused AI products. The substantial prize pool signals robust governmental backing and could stimulate a wave of home‑grown solutions, decreasing reliance on foreign audit‑technology vendors.

Outlook for AI‑Enabled Regulatory Supervision

NFRA’s dual strategy—conducting ten firm inspections while crowdsourcing AI innovations—illustrates a pragmatic approach to modernising financial oversight. Successful pilot results will shape policy decisions on broader AI adoption, potentially positioning India as a leader in AI‑enabled regulatory supervision for emerging markets.