ING-DiBa is currently experiencing a full‑scale online‑banking outage that prevents customers from logging in, while simultaneously reporting a record‑high net profit of €1.9 billion. The contrast highlights both the bank’s strong financial performance and the urgent need to restore digital access for thousands of users.

Login Outage Details

Customers are unable to access their accounts through the mobile app or web portal. Reported symptoms include error messages, endless loading screens, and complete login failures across all devices. The issue began within the last 24 hours and persists, indicating a systemic technical disruption rather than isolated incidents.

How Customers Can Seek Redress

Account holders affected by the outage may file formal complaints through ING‑DiBa’s designated contact point:

- ING‑DiBa AG

- 60628 Frankfurt am Main

- https://www.ing.de/hilfe/

These channels provide a structured path for compensation requests and further assistance.

Record‑Breaking Profit Figures

Despite the technical glitch, ING‑DiBa announced a net profit of €1.9 billion for the latest reporting period, ranking among the highest in its history. The earnings exceeded analyst expectations, prompting the bank to raise its outlook for the upcoming fiscal year.

Digital Banking Context

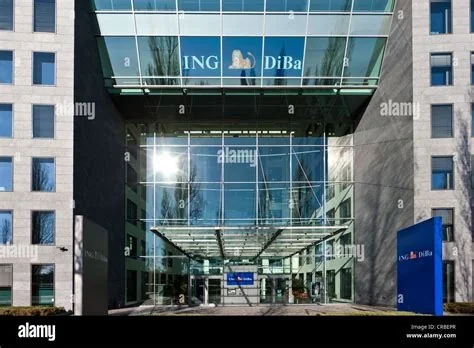

As Germany’s most popular direct bank, ING‑DiBa relies heavily on a digital‑first model for services such as current accounts and mortgage financing. Any disruption to its online platform can significantly impact customer trust and brand perception, especially amid competitive pressure from fintech rivals and traditional banks investing in robust digital infrastructure.

Potential Implications and Next Steps

Restoring login functionality remains the immediate priority. The bank’s response speed and transparency will influence customer satisfaction and the effectiveness of the complaint process. From an operational perspective, the outage underscores the need for stronger redundancy, incident‑response protocols, and ongoing infrastructure upgrades funded by the strong profit margin.

Bottom Line

ING‑DiBa’s situation illustrates the delicate balance between delivering cutting‑edge digital services and maintaining the operational stability customers expect. While the €1.9 billion profit provides financial flexibility, the ongoing login crisis highlights that digital reliability remains a non‑negotiable pillar of modern banking.