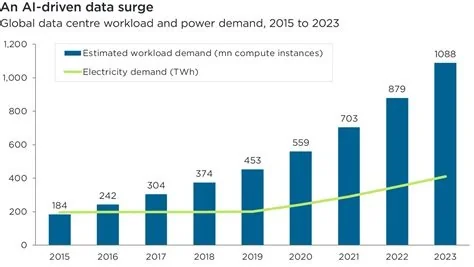

AI‑driven compute demand is outpacing semiconductor supply, creating a perfect storm of chip shortages, soaring memory prices, and storage constraints. Data‑center operators, cloud providers, and device manufacturers are all feeling the impact as GPUs, CPUs, DRAM, and NAND flash become scarce and costly, prompting industry leaders to rethink production and inventory strategies.

AI Fuels a Multi‑Hundred Billion Semiconductor Market

The rapid adoption of generative‑AI models has propelled the global semiconductor market toward a valuation of nearly $800 billion. High‑performance GPUs dominate this growth, capturing the majority of new revenue as they power AI training and inference workloads across data centers.

Memory Shortages Intensify as AI Consumes Capacity

AI workloads now reserve roughly 70 % of worldwide DRAM capacity, tightening supply and driving NAND flash shortages. The resulting scarcity has pushed memory and SSD prices up by as much as 250 % year‑over‑year, a level unprecedented in recent memory cycles.

Foundry Capacity Strains Under Rising AI Demand

Leading foundries remain confident in sustained AI demand, yet the rapid expansion of compute workloads threatens fab capacity. Advanced‑node logic production, essential for next‑generation GPUs and custom accelerators, is approaching its limits as supply‑chain bottlenecks persist.

CPU Supply Tightens Amid AI Workloads

Data‑center CPU inventories are experiencing “peak‑Q1” shortages as AI workloads surge. Manufacturers are shifting production toward high‑performance Xeon‑class chips, a move that may raise the price of consumer‑grade PCs in the short term while addressing immediate data‑center needs.

Impact on Consumer Devices

Higher CPU and memory costs are filtering down to end‑users, increasing the overall price of laptops, desktops, and AI‑enabled gadgets.

GPU and Data‑Center Revenue Boom

AI‑centric GPU and data‑center sales are projected to generate $600 billion in revenue, driven by exploding demand for accelerated compute and the parallel rise in global power consumption required to sustain AI infrastructure.

Semiconductor Revenues Top $1 Trillion but Cost Risks Grow

Overall semiconductor revenues have breached the $1 trillion mark, largely fueled by memory and logic demand tied to AI. However, tightening memory supply and rising component costs pose significant margin‑erosion risks for manufacturers.

Investor Sentiment and the AI Dividend

Investors view AI‑driven data‑center demand as a catalyst for higher chip sales, using earnings reports as a barometer for the industry’s ability to convert AI hype into sustainable revenue growth.

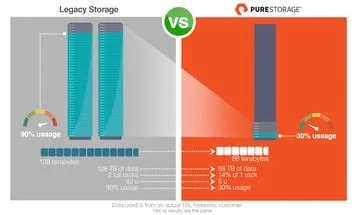

Implications for the Tech Ecosystem

Elevated component prices are reshaping the cost structure of cloud services, enterprise AI projects, and consumer devices that rely on AI acceleration. Companies focused on large‑scale AI training may face higher capital expenditures, prompting a shift toward alternative architectures such as high‑bandwidth memory (HBM) and emerging non‑volatile memory technologies.

Future Outlook for the Semiconductor Industry

While the AI dividend continues to drive revenue, the sector must balance relentless compute demand with pragmatic supply‑chain strategies. Addressing capacity constraints and cost risks will be essential to avoid prolonged shortages and price volatility across the hardware stack.