PayPay Card introduces a new lottery‑style point campaign and the “Super PayPay Festival” with double‑digit discounts, while also reducing point‑return rates for certain transactions starting June 2. Verified users can join the draw by spending ¥200, enjoy higher savings during the March festival, and must reassess the card’s value for routine bill payments after the rate change.

Lottery‑Style Point Campaign Launch

How the Draw Works

Verified PayPay Card holders who spend ¥200 or more at participating merchants are entered into a draw with a 50 % chance of winning PayPay points. The campaign begins immediately, and identity verification may take up to three days. This incentive aims to boost transaction volume by rewarding incremental purchases.

Super PayPay Festival Starts March 3

Festival Benefits Overview

The Super PayPay Festival runs across both physical stores and online retailers that accept PayPay or PayPay Card. Shoppers can enjoy large‑scale discounts and special offers designed to increase engagement during the spring shopping season. The festival leverages PayPay’s network of over 1.6 million locations, creating seamless earn‑and‑redeem opportunities.

Security and Convenience Upgrades for 2025

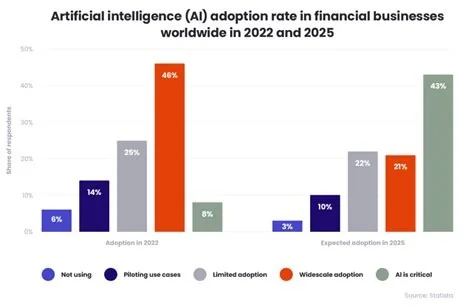

PayPay Card’s 2025 roadmap highlights tighter integration with the PayPay cashless service and enhanced anti‑fraud measures. Upgrades include real‑time transaction monitoring powered by machine‑learning, expanded biometric authentication in the app, and a faster dispute‑resolution workflow to reduce reimbursement times for fraudulent charges.

Point‑Return Rate Reduction Effective June 2

Starting June 2, points will no longer be awarded for top‑up transactions, and the reward rate for utility payments (electricity, water, taxes) drops from 1 % to 0.5 %. This adjustment aligns with industry trends to recalibrate reward programs amid tighter profit margins and regulatory scrutiny.

Consumer and Merchant Implications

The combination of a high‑visibility lottery and a points‑rate cut creates a mixed landscape. Short‑term incentives may increase purchase frequency and foot traffic, while the reduced rewards for essential services could diminish the card’s perceived value for cost‑conscious users. Merchants can benefit from festival traffic but may need to adjust pricing strategies to accommodate changing consumer behavior.

Practitioner Insight

Yuki Tanaka, senior product manager at an e‑commerce platform, notes that the lottery campaign drives incremental spend without broad discounts, but the upcoming points reduction requires clear communication to customers who rely on cash‑back for utilities. Balancing promotional spikes with baseline reward expectations is essential for maintaining long‑term satisfaction.

Future Outlook

PayPay’s dual strategy of aggressive promotions and a recalibrated rewards framework reflects a shift toward sustainable profitability in cashless payments. Success will depend on maintaining user trust while delivering tangible value during the March festival and after the June points adjustment.