OCCU has teamed up with Floify to power its mortgage operations with an AI‑enabled point‑of‑sale platform. The new system automatically extracts data from borrower documents, pre‑populates applications, and streamlines communication, letting loan officers focus on advising while borrowers enjoy faster approvals. This move positions OCCU at the forefront of member‑centric digital lending.

Why OCCU Chose Floify’s AI‑Driven POS

OCCU evaluated dozens of solutions and zeroed in on three core pillars: workflow efficiency, clear communication, and future‑proof scalability. While many vendors offered similar features, Floify’s collaborative service model and roadmap of AI enhancements tipped the scales. Members expect a seamless experience, and the AI engine delivers exactly that.

Key Benefits for Borrowers and Loan Officers

The AI engine extracts data from uploaded paperwork in seconds, cutting manual entry time dramatically. For borrowers, this means approvals can arrive in days instead of weeks. For loan officers, a single dashboard flags missing items and updates file flow in real time, so you’ll spend less time chasing documents and more time advising clients.

Speed and Accuracy

- Automatic data extraction reduces errors.

- Pre‑populated applications accelerate the underwriting process.

- Real‑time file visibility minimizes back‑and‑forth emails.

Enhanced Communication

- Secure portal connects lenders, borrowers, and referral partners.

- Instant notifications keep all parties informed.

- Configurable alerts ensure nothing falls through the cracks.

Impact on the Credit Union Mortgage Landscape

Historically, credit unions lagged behind big banks in adopting cutting‑edge mortgage tech. By integrating Floify’s AI‑driven POS, OCCU is closing that gap and setting a new benchmark. You’ll see other member‑owned institutions consider similar upgrades as borrowers increasingly demand mobile‑first, instant experiences.

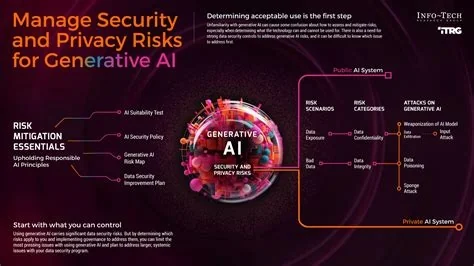

Considerations Around Data Security and AI Transparency

Any AI‑based system raises questions about data privacy and algorithmic accuracy. OCCU must ensure the extraction engine handles diverse document formats reliably and that borrowers feel comfortable entrusting sensitive information to an algorithm. Ongoing monitoring and clear communication will be essential to maintain trust.

Practical Takeaways for Mortgage Professionals

Bill Bolton, OCCU’s mortgage strategy lead, emphasizes three tangible outcomes: improved file‑flow visibility, reduced back‑and‑forth communication, and smoother borrower journeys. If you’re a loan officer, you’ll notice a single dashboard that automatically pulls in borrower data, flags missing items, and lets you focus on closing deals rather than data entry.

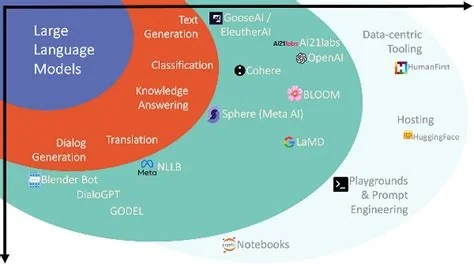

Future Outlook for AI in Member‑Centric Lending

OCCU’s early adoption signals a broader shift: fintech solutions are becoming core infrastructure for credit unions. As more institutions embrace AI, the industry’s tech race will no longer be dominated solely by big banks. The momentum is building, and AI is the engine driving member‑focused innovation forward.