JPMorgan’s research team says the rapid rise in AI spending is pushing smaller banks toward consolidation. As AI moves from experimental tools to core‑system engines, the price tag is climbing faster than many community banks can bear. If you’re watching the banking sector, expect the cost pressure to spark a wave of mergers soon.

Why AI Spending Pressures Smaller Banks

AI is no longer a side project; it’s becoming the engine that drives loan underwriting, risk analysis, and payment processing. The technology promises faster decisions and personalized service, but the investment often runs into the low‑millions for a single model. Smaller institutions that can’t justify that outlay are forced to consider partnership or acquisition as a survival tactic.

Rising Costs Versus Competitive Edge

When a community bank faces a multi‑million‑dollar AI platform, the cost can erode already thin margins. At the same time, larger banks leverage scale to spread those expenses across broader revenue streams, gaining an operational edge that’s hard to match. You’ll notice that the gap between AI‑enabled giants and cash‑strapped locals widens with every new deployment.

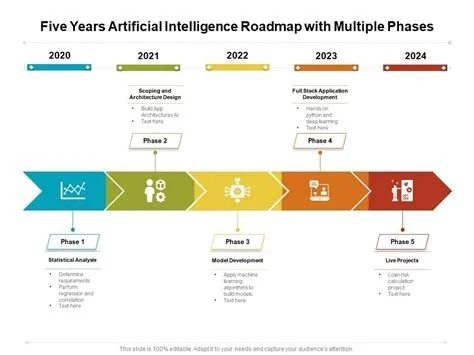

JPMorgan’s Plan to Scale AI Across Its Business

To offset the financial strain, JPMorgan is centralizing AI leadership under a new chief operating officer for its combined commercial and investment bank. The goal is to embed AI at every decision point—whether it’s deal origination, post‑trade analytics, or client servicing—so the cost is amortized over a larger profit base. This coordinated push aims to make AI investment palatable while keeping the firm ahead of the competition.

Regulatory Landscape and Future Outlook

Regulators are sharpening their focus on AI‑driven decision‑making in finance. They’re asking how banks will ensure transparency, fairness, and compliance when algorithms influence credit approvals and risk assessments. As oversight tightens, banks that can afford robust AI governance will have a clear advantage, while those that can’t may find merger talks becoming inevitable.

- Cost pressure: AI platforms often cost millions, squeezing small‑bank margins.

- Scale advantage: Larger banks spread AI expenses across diverse revenue streams.

- Regulatory scrutiny: Governance requirements add another layer of investment.

- Strategic response: Consolidation emerges as a practical path for many community banks.