The European Commission has issued a formal order that forces Google to separate part of its ad‑tech business and to provide anonymised search‑behavior data for AI‑driven bidding. This move aims to curb Google’s dominance in online‑ad auctions, increase market fairness, and give advertisers clearer insight into how bids are calculated.

EU Specification Proceedings Under the DMA

Under the Digital Markets Act, the Commission opened two parallel specification tracks that spell out exactly what compliance will look like for Google.

Android Interoperability Requirements

- Google must grant third‑party AI providers equal access to Android hardware and software features that power its AI services.

- The rule targets “equally effective access,” ensuring that competitors can tap Android capabilities on a level playing field.

Search‑Data Sharing Obligations

- Google is required to offer fair, reasonable, and non‑discriminatory (FRAND) access to anonymised ranking, query, click‑through, and view data collected through its search engine.

- The data must be delivered via a structured interface rather than a raw firehose of keyword logs.

Record Antitrust Fine and Potential Divestiture

The Commission is also moving to enforce a €2.95 billion antitrust penalty for abusing its dominant position in automated ad‑auction tools. By controlling the technology that runs online ad auctions, Google could manipulate outcomes to its own advantage. The fine is the largest ever imposed on a tech company by the EU, and regulators have signalled that a divestiture of part of Google’s ad‑tech assets may be required to eliminate the conflict of interest of running both sides of the auction.

Why the EU Is Tightening Controls

The DMA was created to stop “gatekeeper” platforms from setting the rules of competition simply because they own critical infrastructure. Search and mobile operating systems are textbook examples, as they dictate how users discover content and how developers reach audiences. By forcing Google to share anonymised search data and open Android’s AI‑enabled features, the Commission aims to dismantle the data‑as‑weapon advantage that has long underpinned Google’s ad‑tech dominance.

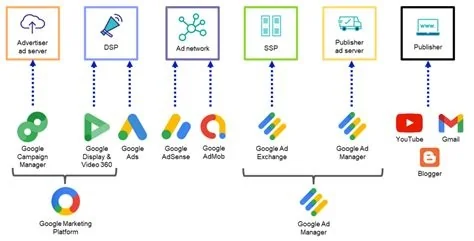

Impact on the Digital Advertising Ecosystem

If Google provides FRAND‑based access to its search‑behavior datasets, third‑party ad‑tech firms can build more accurate bidding models without relying on opaque, proprietary signals. That could level the playing field for smaller players and spur innovation in AI‑driven optimisation. At the same time, a forced divestiture would reshape Alphabet’s revenue landscape, pushing the company to double‑down on cloud and AI services.

Publishers may also feel the shift. A more fragmented supply chain could raise integration costs, but it might also reduce the “auto‑preference” bias that has historically favoured Google’s own inventory, giving you more control over where ads appear on your site.

Practitioner Viewpoint

“Access to a standardised, anonymised search‑behavior feed would transform how we build bidding models,” says a senior programmatic strategist at a European media agency. “We’ve spent years reverse‑engineering signals. A clear, FRAND‑based API would let us create transparent models and give our clients confidence that the auction isn’t tilted in favour of the platform.”

What Happens Next?

The Commission plans to publish draft measures by early April and a final decision by July. Google has not commented publicly, but its recent surge in AI spending suggests the company is preparing to reinforce its cloud and AI offerings while navigating the new regulatory landscape. Stay tuned, because the outcome will shape the European digital advertising market for years to come.