Goldman Sachs is rolling out autonomous AI agents built on Anthropic’s Claude model to handle trade accounting, reconciliation, and client onboarding. These agents can ingest trade data, match entries, flag discrepancies, and generate compliance paperwork without manual input, promising faster workflows and fewer errors. If you’re watching Wall Street, this move could reshape how banks manage back‑office operations.

Why Goldman Sachs Is Automating Back‑Office Tasks

The back‑office has long been a bottleneck for banks. Manual trade reconciliation can drag on for days, and onboarding new clients often involves a maze of forms and checks. By automating these processes, Goldman aims to shave hours off each workflow, letting staff focus on higher‑value activities.

How Claude Agents Work

Claude, Anthropic’s flagship large‑language model, is wrapped in a suite of task‑specific agents. One agent tackles trade accounting, another handles client onboarding, and a third monitors compliance. Each agent pulls data from internal systems, applies business rules, and produces audit‑ready outputs while staying under human oversight.

Benefits for the Bank

- Speed: Processes that once took days can now be completed in hours.

- Accuracy: Automated checks reduce the risk of human error.

- Efficiency: Staff can shift from repetitive data entry to supervising AI outputs.

- Scalability: The agents can handle growing transaction volumes without proportional headcount increases.

Potential Challenges and Risks

Regulatory Compliance

Automating compliance means the AI must stay current with ever‑changing regulations across jurisdictions. A single misstep could trigger costly fines, so continuous monitoring and rapid model updates are essential.

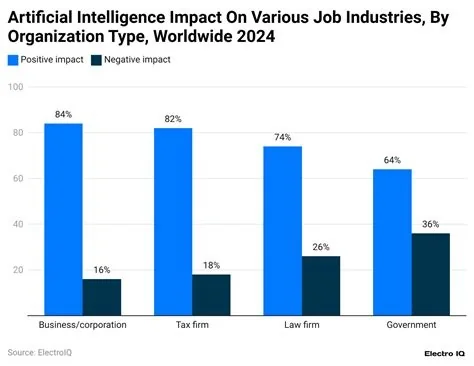

Impact on Workforce

The CIO emphasizes that the AI won’t replace staff outright but will “boost efficiency while controlling headcount.” In practice, employees may transition from manual entry to roles that oversee AI decisions and manage exceptions.

What This Means for the Financial Industry

If Goldman Sachs can demonstrate measurable speed gains and error reductions, other large institutions are likely to follow suit. The deployment signals a shift from experimental pilots to production‑grade AI that underpins core banking functions.