Fujikura has lifted its FY2026 profit outlook, citing a surge in demand for optical‑fiber products fueled by generative‑AI workloads, and it is raising its year‑end dividend. The company reported a net profit of ¥30.35 billion for the nine months ended December 2025, translating to an 11.5 % margin, and promises stronger returns for shareholders.

Why AI Is Driving Fujikura’s Fiber Surge

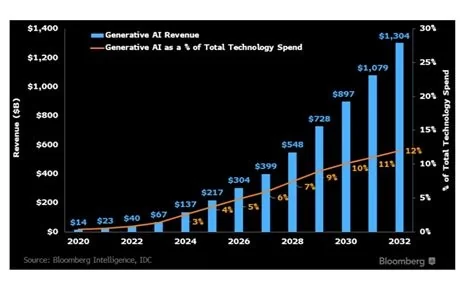

Generative‑AI models chew through petabytes of data, forcing hyperscale cloud providers to expand high‑speed interconnects. Those upgrades rely on low‑latency, high‑capacity fiber cables—exactly what Fujikura manufactures. As AI workloads grow, you’ll see more operators treating fiber as a strategic asset rather than a commodity.

Financial Highlights and Dividend Upgrade

Profit Forecast and Margin

The revised outlook reflects a 10.04 % rise in production costs, but a 29.25 % jump in gross profit for the nine‑month period. After expenses, the net profit hit ¥30.35 billion, delivering an 11.5 % margin. This strong performance underscores Fujikura’s cost advantage from vertically integrated production.

Dividend Outlook

Fujikura also lifted its dividend‑per‑share guidance, though the exact figure remains undisclosed. The higher payout signals confidence that the AI‑driven demand surge is sustainable, not a fleeting hype wave.

Market Reaction and Investor Appeal

Following the announcement, Fujikura’s shares slipped modestly, suggesting short‑term skepticism. However, the dividend increase could attract income‑focused investors, helping to stabilise the stock over the longer term. If you’re tracking dividend‑yield opportunities, Fujikura now looks more appealing.

Practitioner Insights: Fiber in AI‑Powered Data Centers

Network engineers report a surge in orders for 400‑Gbps and 800‑Gbps links to support AI clusters. “We’re specifying Fujikura’s ultra‑low‑attenuation cables for our next‑gen AI builds,” says a senior design lead at a major cloud provider. The performance gains translate directly into lower power consumption, a win for both cost and sustainability targets.

Future Outlook for Fujikura and the Fiber Supply Chain

If AI‑driven data traffic continues its exponential climb, the entire fiber‑optic supply chain could see tighter capacity and higher margins. Fujikura’s ability to scale production without compromising quality will be critical. Should the company keep delivering on this dual promise, its FY2026 outlook may become a benchmark for other traditional hardware firms eyeing AI‑related growth.

Key Takeaways

- Profit outlook raised amid AI‑fuelled fiber demand.

- Dividend per share increased, signaling confidence in sustained growth.

- AI workloads are driving a shift toward high‑capacity, low‑loss fiber solutions.

- Investors seeking dividend yields may find Fujikura increasingly attractive.

- Continued production scaling will be essential to meet global AI infrastructure needs.