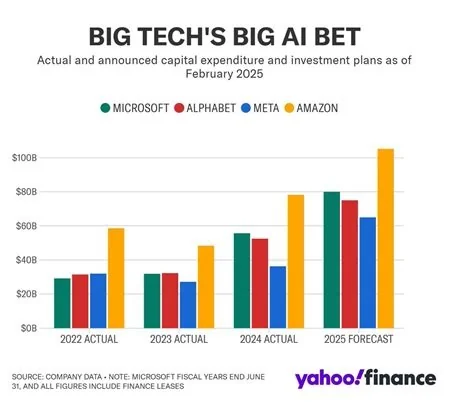

Big Tech’s AI spending is set to hit between $650 billion and $700 billion, dwarfing historic U.S. infrastructure outlays. Companies like Alphabet, Amazon, Microsoft and Meta are pouring cash into data‑center expansion, next‑gen models, and specialized chips. This massive investment aims to lock in compute advantage, lower costs, and deliver faster AI services for businesses like yours.

Why Big Tech Is Investing Hundreds of Billions in AI

The race for AI dominance has turned into a capital‑intensive sprint. By committing such scale, the leading firms secure the hardware and talent pipelines needed to stay ahead of emerging competitors. You’ll notice that the spend isn’t just about buying more GPUs—it’s about building an end‑to‑end ecosystem that can sustain petaflop‑scale workloads.

What the Spending Powers: Compute, Models, and Chips

These billions fund three core pillars:

- Compute expansion: hyperscale data centers packed with the latest GPUs, ASICs, and TPU‑v5 pods.

- Model development: training next‑generation foundation models and multimodal vision systems.

- Custom silicon: proprietary chips like Amazon’s Trainium and Microsoft’s Azure AI super‑clusters.

Each pillar reinforces the others, creating a feedback loop that accelerates innovation and reduces per‑inference costs.

Strategic Implications for Competitors and Customers

The massive outlay builds a moat around AI services. Smaller players will likely rely on the cloud platforms of these giants, carving out niche use‑cases that don’t demand raw compute horsepower. For you, this means access to more affordable, enterprise‑grade AI tools—provided you stay within the ecosystems they control.

Competitive Landscape

First‑to‑scale advantage translates into:

- Lower operational expenses for AI workloads.

- Faster iteration cycles for new models.

- Pricing power that can outmatch newer entrants.

Environmental and Financial Risks

Spending at this magnitude raises two red flags. The energy demand of hyperscale data centers draws scrutiny from regulators concerned about carbon footprints. At the same time, the surge in capital expenditures can compress profit margins if AI‑driven revenue streams don’t keep pace.

What This Means for You and the Future of AI

As the private sector mirrors a national mobilization, the ripple effects will shape the entire AI market. You can expect:

- More robust AI services integrated into everyday business workflows.

- Potential price competition as smaller firms find creative ways to differentiate.

- Increased regulatory focus on sustainability and market concentration.

Ultimately, the $650‑$700 billion spend aims to turn AI into a trillion‑dollar engine of growth. Whether that translates into lasting value for customers, shareholders, and society will depend on how responsibly the technology is deployed.