Amazon unveiled a $200 billion capital‑expenditure plan focused on AI, robotics and satellite infrastructure, instantly sending the stock down more than 4 % and wiping roughly $100 billion from its market value. The move dwarfs rivals’ spending and raises fresh questions about cash flow, margin pressure and the timeline for returns. You’ll want to know how this gamble could reshape the cloud market.

The Scale of the $200 B Commitment

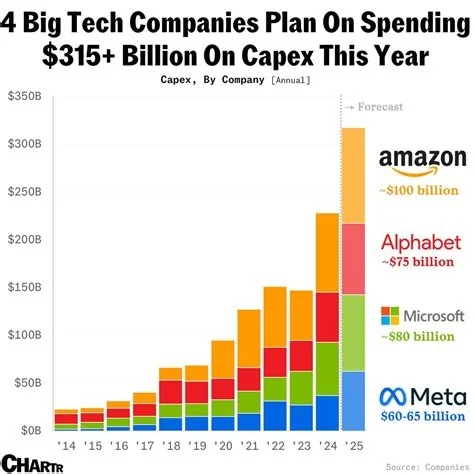

Amazon’s 2026 capex target is more than double the combined spend of its three biggest competitors. While Alphabet plans around $75 billion, Microsoft targets roughly $80 billion and Meta aims for $60‑65 billion, Amazon alone accounts for almost the entire industry total. This unprecedented scale signals a bold bet on AI‑driven growth.

Financial Snapshot: Q4 2025 Results

Revenue rose 14 % year‑over‑year to $213.4 billion, and net income climbed to $21.2 billion, just shy of analysts’ expectations. AWS delivered $35.6 billion in quarterly revenue—a 24 % jump and the fastest growth in 13 quarters. Despite these strong numbers, the capex announcement eclipsed the earnings beat.

Analyst Perspectives: Opportunity or Risk?

Three major firms weighed in on the massive spend:

- Jefferies warned that AWS’s backlog growth, while impressive, “pales versus capex growth and peers.” The firm kept a “Buy” rating but asked for clearer proof of return on capital.

- Wedbush highlighted the “strongest year‑over‑year growth within AWS” and noted a planned doubling of capacity by 2027. Still, it lowered the price target to $300, citing near‑term margin pressure.

- Bank of America echoed the sentiment that the $200 billion guide “pressured stock,” yet called the capacity build essential for cloud leadership, maintaining a “Buy” rating with a $275 target.

Investor Concerns Over Cash Flow

Amazon’s aggressive reinvestment strategy has always been a double‑edged sword. Free cash flow is already tight after previous data‑center builds and logistics upgrades. With a $200 billion outlay, the company must generate enough operating cash to avoid eroding its balance sheet, and many investors are watching the cash‑flow runway closely.

Industry Viewpoint from a Data‑Center Engineer

“From a data‑center engineer’s point of view, a $200 billion capex plan translates to thousands of new racks, custom ASICs, and massive power‑distribution upgrades,” says a senior infrastructure architect. “The challenge isn’t just building the hardware; it’s integrating it into a seamless AI service stack that customers can actually use. If Amazon can pull that off, the upside is huge. If not, the balance sheet will feel the strain.”

What to Watch Next

The 2026 spend will be spread across retail, logistics and cloud divisions, with AI acting as the connective tissue. Your next clue will come from the upcoming earnings report—will the AI‑centric investments translate into higher‑margin services? Keep an eye on margin trends, cash‑flow metrics and any updates to the capex rollout schedule.