On a busy payday in Mexico, Santander’s mobile app suffered a widespread outage that blocked login, balance checks, and transactions for millions of users. The failure struck during the bi‑weekly payroll period, leaving workers unable to verify deposits or pay bills. Santander confirmed technical teams are investigating, but no timeline for restoration has been provided.

What Caused the Outage

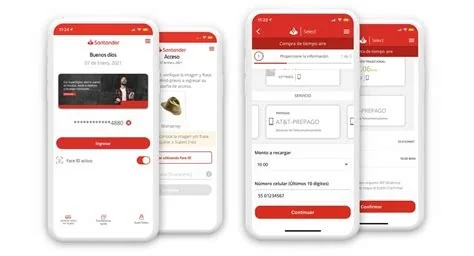

Users began experiencing freezes on the login screen, error messages, and complete lock‑outs as early as the morning. The app would stop responding after credentials were entered, preventing essential actions such as bill payments, fund transfers, and balance inquiries. By midday, complaint volumes surged, prompting the bank to acknowledge the issue without offering a detailed cause.

Why the Timing Is Critical

The outage coincided with Mexico’s “quincena,” the semi‑monthly payday when salaries are deposited and immediate financial obligations are met. Inability to access the banking app during this window can disrupt cash flow, delay rent or utility payments, and force users to seek costlier alternatives.

Impact on Payroll and Daily Transactions

During the payroll window, millions rely on digital channels to confirm salary deposits and manage expenses. The outage prevented users from:

- Verifying that payroll funds had arrived.

- Scheduling or executing bill payments.

- Transferring money to family or service providers.

- Using QR‑based payments for everyday purchases.

Technical Factors Behind Mobile Banking Failures

While the exact trigger remains undisclosed, similar banking outages are often linked to:

- Server overload caused by sudden spikes in user traffic.

- Software bugs introduced during recent app updates.

- Failures in third‑party authentication services.

- Systemic issues affecting multiple device types and operating systems.

Each update to a platform serving tens of millions of customers carries a risk of unintended side effects, especially when deployed at scale.

Customer Consequences

- Inability to confirm salary deposits, increasing the risk of overdraft fees.

- Forced reliance on physical branches, leading to longer wait times and higher operational costs.

- Potential exposure to fraud when seeking alternative payment methods.

- Reduced confidence in digital banking reliability.

Regulatory Expectations

Mexico’s banking regulator requires institutions to maintain service continuity and promptly notify users of significant interruptions. Although no formal complaint has been filed, the scale of this incident may trigger a review of Santander’s incident‑response protocols and its redundancy measures.

Future Outlook for Digital Banking Resilience

The outage highlights the growing dependence on mobile platforms for everyday banking in Mexico. To restore trust, banks must invest in robust infrastructure, including load‑balancing, automated failover systems, and transparent communication channels. Customers are advised to monitor official updates and, if urgent, use web‑based banking or visit a branch until the app is fully restored.