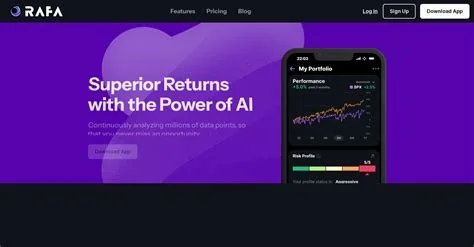

RAFA_AI has introduced a suite of AI agents that continuously monitor financial markets, ingest live data streams, and generate actionable insights without human intervention. The agents process stock tickers, news alerts, social sentiment, and macro‑economic indicators in real time, delivering concise alerts, trade suggestions, or automated order execution through brokerage APIs.

How the Agents Work

Data Sources and Processing

The agents pull from multiple market feeds—including real‑time ticker updates, newswire releases, social‑media sentiment analysis, and macro‑economic reports—and apply large‑language‑model reasoning combined with algorithmic trading heuristics. Within seconds, the system transforms raw inputs into structured information ready for decision‑making.

Actionable Outputs

Based on the processed data, the agents can:

- Generate concise alerts that highlight emerging market trends.

- Recommend trade adjustments or position rebalancing.

- Execute pre‑approved orders automatically via integrated brokerage APIs.

Why Real‑Time AI Agents Matter in Finance

In high‑frequency trading environments, milliseconds separate profit from loss. Autonomous agents eliminate the latency of manual analysis, allowing firms to act on market shifts instantly. This speed advantage creates a competitive edge for both boutique firms lacking extensive data‑science resources and large institutions seeking to augment existing quantitative strategies.

RAFA_AI’s Position in the Autonomous AI Landscape

RAFA_AI targets the upper‑mid tier of autonomous agents by incorporating memory of prior market events, multi‑channel triggers (such as Slack alerts and email digests), and standardized output formats like JSON‑encoded trade signals. The platform also supports versioned prompt libraries, ensuring consistent behavior across deployments.

Potential Business Impact

- Democratization of algorithmic trading: Smaller firms can leverage sophisticated AI without building in‑house models.

- Enhanced strategy agility: Large institutions gain an extra layer of speed and adaptability for existing quantitative frameworks.

- Rapid prototyping: Companies can experiment with AI‑as‑a‑Service platforms to test new trading ideas quickly.

Governance and Risk Management

To address trust and compliance concerns, RAFA_AI embeds comprehensive audit logs and human‑in‑the‑loop checkpoints. These safeguards provide transparency for regulatory review and enable traders to verify algorithmic decisions before execution.

Future Outlook for Autonomous Finance

The launch signals a broader shift toward “agentic AI” that can operate continuously, retain contextual memory, and manage complex workflows without constant supervision. As more firms adopt such agents, the distinction between co‑pilot tools and true autopilot systems will become clearer, shaping the next phase of autonomous finance.