Private equity firms are reshaping the digital‑engineering services sector by injecting capital into AI‑enabled capabilities, pushing average M&A deal sizes above $200 million. This surge reflects rapid market expansion, heightened demand for AI talent, and a strategic focus on shorter investment cycles, positioning PE‑backed platforms as the dominant buyers in mid‑size transactions.

Deal‑Making Surge in AI‑Enabled Digital Engineering

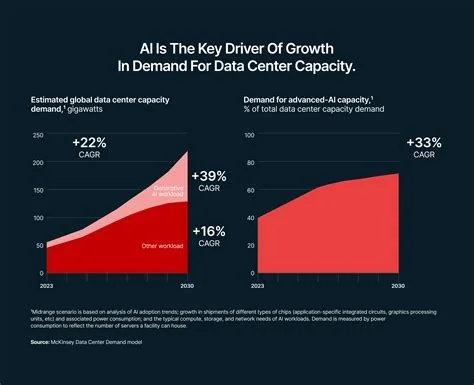

The digital‑engineering market is evolving from traditional custom software development to cloud‑native product engineering, software modernization, and embedded AI solutions. Industry analysis projects the sector to grow from $170 billion today to $550 billion by 2030, driven by strong buyer interest and a receptive environment for rapid exits.

Market Expansion and Growth Forecast

Companies that once generated under $100 million in revenue are now crossing that threshold, with several surpassing $300 million and larger players reaching the $1‑$2 billion band. This scaling reflects both organic growth and the acceleration provided by private‑equity‑backed acquisitions.

PE‑Backed Platforms Dominate Mid‑Size Acquisitions

Private‑equity‑backed digital‑engineering firms now account for more than 40 % of deal volume in the mid‑size “tuck‑in” space, a dramatic rise from roughly 20 % a few years ago. Their capital flexibility and focus on quick value creation make them preferred buyers over strategic listed companies.

Notable Transactions Driving Scale

Recent high‑profile deals include a PE‑owned platform acquiring a specialized software quality‑engineering firm to add AI‑driven testing capabilities, and other strategic purchases that broaden AI‑centric service portfolios. These transactions illustrate how PE capital is used to embed advanced technologies and expand market reach.

AI Talent Amplification Through Acquisitions

Acquiring firms with niche AI expertise—such as machine‑learning model development, AI‑powered analytics, and intelligent automation—allows PE‑backed platforms to deliver end‑to‑end digital‑engineering solutions. Executives note that the rapid evolution of hardware, AR/VR, and AI creates a talent premium that private equity can capture through targeted purchases.

Market Implications of Private‑Equity Activity

- Consolidation Pressure: Smaller independent players face increased incentives to seek PE backing or become acquisition targets to remain competitive.

- Valuation Upside: With average deal sizes exceeding $200 million, valuation benchmarks for mid‑market firms are being reset, influencing future capital costs.

- Faster Exit Pathways: PE investors aim for 3‑5‑year exit horizons, accelerating IPOs or strategic sales and enhancing liquidity in the sector.

- Technology Acceleration: Infusion of AI expertise speeds the rollout of services such as AI‑enhanced product design, predictive maintenance, and immersive AR/VR experiences.

Future Outlook for Digital Engineering

If current growth trends continue, the digital‑engineering market could more than triple by the end of the decade, creating fertile ground for further PE‑driven consolidation. AI‑enabled engineering is transitioning from a peripheral offering to a core growth engine, and private equity is positioning itself at the forefront of this transformation.