Nvidia’s $2 B Bet on CoreWeave Fuels a Multi‑Gigawatt AI Factory Push

Deal Overview

In a move that could reshape the AI‑infrastructure landscape, Nvidia has poured $2 billion into cloud‑native GPU specialist CoreWeave. The equity infusion—executed at $87.20 per share—makes Nvidia the cloud provider’s second‑largest shareholder and the largest external stake the chipmaker has ever taken in an AI cloud player.

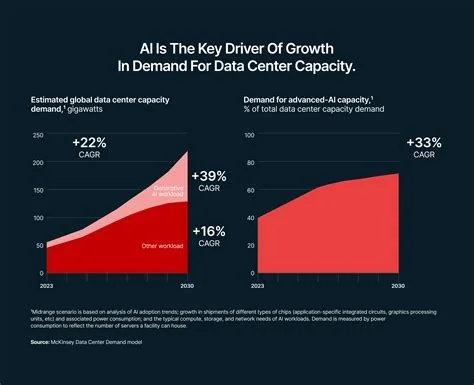

CoreWeave, founded in 2017, already runs a “GPU‑first” architecture that differentiates it from hyperscale rivals. The new capital will fast‑track the construction of more than 5 GW of AI‑optimized data‑center capacity—so‑called “AI factories”—with a target completion date before the decade ends.

Accelerating the AI Factory Build‑Out

The money isn’t just for buying more GPUs. CoreWeave will use it to lock down sites, upgrade power infrastructure, and erect shell structures for new data‑center locations across multiple geographies. By shortening the typical multi‑year rollout, the partnership aims to meet the surging demand for large‑scale model training and inference.

Beyond bricks and wires, the deal deepens a technical alliance that began years ago. CoreWeave will integrate Nvidia’s Vera CPU platform, Bluefield storage solutions, and upcoming GPU families—including the Rubin architecture for training and the Blackwell inference engine for low‑latency serving. Joint testing of CoreWeave’s “Mission Control” orchestration layer will embed Nvidia‑optimized reference designs, giving customers a turnkey stack from silicon to software.

Strategic Implications for Both Companies

For Nvidia, the stake secures a steady pipeline of hardware sales and hands‑on insight into real‑world AI workloads. It also diversifies revenue beyond chip sales, embedding the company’s technology across the full AI stack. The partnership creates a vertically integrated pipeline: Hopper GPUs (and future Rubin/Blackwell chips) feed directly into CoreWeave’s cloud‑native platform, which in turn runs the massive training jobs that will push the 5 GW target.

CoreWeave, meanwhile, gains a fortified balance sheet and guaranteed access to Nvidia’s latest silicon. That backing positions it to chase enterprise and research contracts that would have been out of reach for a smaller cloud provider. The company’s leadership says AI succeeds when software, infrastructure, and operations are co‑designed—a philosophy now backed by Nvidia’s engineering muscle.

Market Reaction and Financial Outlook

Investors responded positively. CoreWeave’s shares jumped sharply in pre‑market trading, reflecting confidence that the combined growth trajectory will outpace rivals. Analysts see the equity‑backed partnership model as a validation of the “cloud‑first” approach to AI compute, especially as hyperscalers scramble to keep up with demand.

Financially, the infusion will fund data‑center construction, workforce expansion, and the continued development of CoreWeave’s proprietary orchestration platform. Nvidia, on the other hand, locks in future revenue streams and gains a live testbed for next‑generation GPU designs—a win‑win that could improve its margins in the long run.

Potential Challenges

Scaling to 5 GW isn’t a walk in the park. Both firms must navigate ongoing semiconductor supply‑chain constraints and the risk that AI models will outgrow the planned capacity faster than anticipated. Additional capital or new strategic alliances might be required if demand spikes beyond current forecasts.

There’s also the sustainability angle. CoreWeave has pledged to meet aggressive energy‑efficiency targets, leveraging Nvidia’s power‑management tools and renewable‑energy sourcing wherever possible. Balancing raw compute power with carbon‑footprint concerns will be a tightrope walk.

Practitioners Perspective

Emily Chen, senior ML engineer at a biotech startup: “Having a cloud partner that can guarantee Hopper‑class GPUs and a tightly integrated software stack is a huge relief. We can spin up multi‑node training jobs without worrying about driver mismatches or network bottlenecks.”

Raj Patel, data‑center architect at a Fortune‑500 firm: “The ‘AI factory’ concept is appealing because it bundles power, cooling, and networking into a single, Nvidia‑validated package. It cuts the time we’d normally spend negotiating hardware contracts and testing compatibility.”

Laura Gómez, sustainability lead at an AI research institute: “What excites me is the explicit focus on energy efficiency. If CoreWeave can hit those 5 GW targets while keeping PUE (Power Usage Effectiveness) low, it sets a new benchmark for responsible AI scaling.”

Future Outlook

Looking ahead, CoreWeave plans a multi‑geography rollout of its AI factories, each built to Nvidia’s specifications. The goal is not just raw compute but also a resilient, sustainable infrastructure that can handle the next wave of foundation models—think GPT‑5 and beyond.

For Nvidia, the partnership offers a live laboratory to refine upcoming Rubin and Blackwell chips. Real‑world feedback from CoreWeave’s workloads will likely shape design choices, from tensor core layouts to interconnect bandwidth.

In short, the $2 billion bet ties two innovators together at a pivotal moment for AI. If they can navigate supply constraints, keep sustainability in focus, and deliver on the 5 GW promise, the AI factory model could become the new standard for high‑performance cloud compute.