On 1 January 2026 the Nigerian Communications Commission (NCC) will activate licences for six new Internet Service Providers, allowing them to offer fixed‑line broadband across the country. The move aims to boost competition, lower prices, and improve service quality in a market where mobile data still dominates and broadband penetration lags behind national targets.

Details of the New ISP Licences

Scope and Services

The six operators receive full operating licences that permit the provision of fixed‑line broadband to residential, business, and institutional customers nationwide. While the identities of the new ISPs remain undisclosed in public filings, the licences grant rights to deploy fiber, fixed wireless access, and related infrastructure.

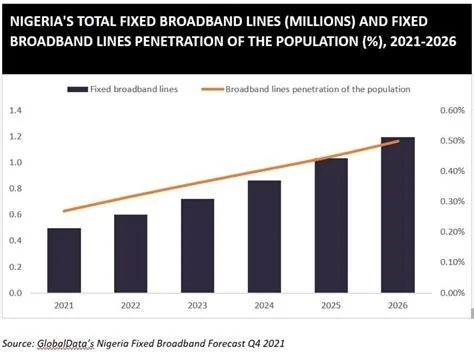

Current Broadband Landscape in Nigeria

Penetration Challenges

Nigeria’s broadband penetration is well below the 30 % target set for 2025, with most internet traffic still carried on mobile data plans. Existing fixed‑line providers such as Spectranet, Smile Communications, and MainOne face intense pressure from aggressive mobile‑network operator bundles and emerging low‑latency satellite services.

Regulatory Context

Broadband for All Framework

The licences are the first issued under the updated “Broadband for All” framework introduced in 2022. The policy offers incentives for fiber deployment, allocates spectrum for fixed wireless access, and streamlines licensing procedures, signaling the NCC’s commitment to a more open and competitive market.

Consumer and Incumbent Implications

Potential Benefits for Users

- More plan choices – New entrants can offer diverse pricing tiers and service bundles.

- Lower monthly fees – Competition typically drives down costs for end‑users.

- Improved reliability – Additional network build‑out encourages better uptime and speed performance.

Pressure on Existing Providers

Incumbent broadband firms may experience margin compression as new players vie for market share. The heightened competition could trigger consolidation, strategic partnerships, or mergers aimed at achieving economies of scale.

Key Challenges for New Entrants

Despite the licensing boost, operators must navigate power reliability issues, high import duties on networking equipment, and lengthy right‑of‑way approvals. The NCC will enforce performance metrics, including minimum speed thresholds and uptime guarantees, with penalties for non‑compliance.

Future Outlook and Timeline

The licences become active at the start of 2026, giving operators a year to secure financing, obtain site permissions, and commence infrastructure deployment. If milestones are met, Nigeria could see a noticeable shift in broadband dynamics by 2027, with more households and businesses accessing reliable fixed‑line internet.