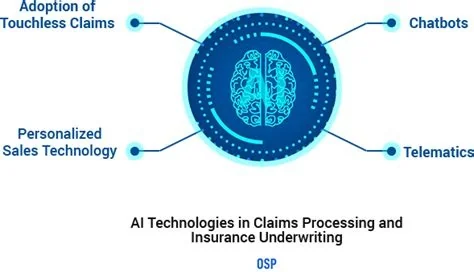

InsurTech AI platforms are transforming insurance by automating claim handling and underwriting. Advanced computer‑vision and natural‑language‑processing tools read documents, evaluate images, and generate risk scores in minutes, delivering faster settlements, tighter fraud detection, and personalized pricing. The result is lower operational costs, higher customer trust, and a competitive edge for insurers that adopt these intelligent solutions.

AI‑Powered Claims Automation

Modern claim engines use AI to interpret loss notices, extract data from photos and videos, and route cases without manual intervention. Real‑time triage directs simple claims to instant settlement while escalating complex situations to human adjusters for review.

- Computer vision extracts damage details from images, enabling instant repair estimates.

- Natural language processing reads claim documents and classifies issues automatically.

- Automated workflows create auditable records that support regulatory compliance.

Benefits for Insurers and Customers

Automation reduces administrative burden, shortens settlement cycles, and provides policyholders with digital updates and self‑service tools, boosting satisfaction and trust.

Smart, Fast Underwriting with AI

AI‑driven underwriting engines ingest telematics, IoT sensor data, and alternative sources to calculate risk scores in minutes instead of days. Machine‑learning models generate personalized pricing and coverage recommendations, allowing insurers to offer tailored products at scale.

- Rapid risk assessment accelerates quote generation.

- Data‑rich models improve pricing accuracy and loss ratios.

- Underwriters focus on high‑value consulting rather than manual data entry.

Regulatory and Compliance Advantages

AI creates transparent audit trails and real‑time status updates, helping insurers meet emerging consumer‑protection standards and easing regulatory scrutiny.

Modular AI Platforms Challenge Legacy Systems

New cloud‑native AI solutions are designed as modular add‑ons that integrate with existing core systems, avoiding costly full‑scale replacements. These platforms combine automated decision‑making with human oversight, enabling insurers to modernize operations while preserving control over complex cases.

Strategic Impact on the Insurance Value Chain

By automating repetitive tasks, AI lowers operational expenses, speeds claim settlements, and enhances underwriting precision. Faster payouts reduce loss‑adjustment costs, and more accurate risk scoring improves overall profitability.

Future Outlook for AI‑Driven Insurance

Successful AI adoption requires robust data governance, continuous model monitoring, and bias mitigation. Insurers that embed AI tools into core processes will gain a lasting competitive advantage, delivering faster, more accurate service while maintaining compliance and fostering stronger customer relationships.