San Francisco‑based Humans&, a three‑month‑old AI laboratory founded by veterans of leading AI labs, has closed a $480 million seed round that values the company at $4.48 billion. The unprecedented funding makes Humans& one of the few seed‑stage firms to achieve unicorn status and sets a new benchmark for capital intensity in artificial‑intelligence startups.

Record‑Breaking Seed Funding for AI Startups

The massive seed round highlights a broader surge of deep‑tech capital flowing into AI ventures before product launches. Other AI infrastructure companies have also secured multi‑hundred‑million‑dollar seed investments, underscoring a market that is front‑loading funding into foundational model development and compute infrastructure.

Why the $480M Seed Matters

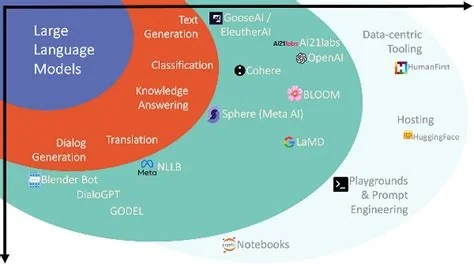

Such a large check reflects the economics of training frontier models rather than traditional SaaS metrics. Building state‑of‑the‑art large‑language models now requires thousands of high‑end GPUs, extensive data pipelines, and electricity consumption comparable to a small municipality, pushing seed‑stage financing into the hundreds‑of‑millions range.

Economic Drivers Behind Massive Seed Rounds

Investors are betting on talent density as the primary asset. The founding team’s pedigree—engineers who have contributed to leading models—has attracted capital even without a public product. This shift signals that top‑tier AI talent has become a standalone valuation driver, decoupled from conventional revenue‑based metrics.

Compute Costs and Talent Density

Securing compute resources now demands capital commitments that dwarf early‑stage SaaS budgets. As a result, seed investors are allocating funds comparable to later‑stage rounds to ensure access to the hardware and expertise needed to compete in the generative‑AI arms race.

Impact on Venture Capital Landscape

The influx of mega‑seed deals raises the bar for subsequent financing rounds. Companies must demonstrate capabilities that rival established players to justify a Series A, intensifying pressure on early‑stage teams to deliver breakthrough models quickly.

Changing Deal Sizes and Competition

Large seed checks effectively squeeze out smaller venture firms, concentrating capital among a handful of deep‑tech‑focused investors. This concentration may limit the diversity of early‑stage funding sources for other AI startups and reshape competitive dynamics within the venture ecosystem.

Redefining Funding Milestones

Traditional definitions of “seed” versus “Series A” are being rewritten. A $480 million injection, once considered a late‑stage war chest, is now classified as seed financing in the AI sector, reflecting how the generative‑AI race is redefining financing milestones across the industry.

From Seed to Unicorn Before Product Launch

Humans& joins a growing cohort of AI companies that achieve unicorn status before shipping a product. The immediate impact of the funding will be the procurement of compute infrastructure and top talent, while the longer‑term implications include faster development cycles for foundational models and heightened competition for GPU resources.

Future Outlook for Humans& and the AI Ecosystem

If Humans& can translate its talent and capital into breakthrough “human‑centric” AI tools, it may set a precedent for how future seed‑stage startups approach fundraising and product strategy. The $480 million seed round stands as a landmark moment that signals both the immense capital appetite for AI and the evolving economics of building the next generation of intelligent systems.