BigBear.ai Holdings (NYSE: BBAI) saw its share price almost double this week as speculation of an AI‑sector merger ignited investor interest. The rally outpaces analyst price targets and technical indicators, prompting traders to weigh the speculative boost against the company’s underlying fundamentals and recent strategic initiatives.

Recent Price Action and Analyst Outlook

The stock closed at $5.72, just below the twelve‑month consensus target of $6.00. Analysts maintain a mixed “Hold” rating, with price targets ranging from $4.00 to $8.00, indicating modest upside compared with the near‑100% jump.

Key Analyst Ratings

- Hold – Majority view, reflecting balanced risk and opportunity.

- Buy – Optimistic about potential merger benefits.

- Sell – Concerned about debt load and lack of clear catalyst.

Technical Signals and Momentum

Technical analysis flags sell signals on short‑ and long‑term moving averages, suggesting the recent surge may be momentum‑driven rather than fundamentals‑driven.

Strategic Moves Strengthening the Business

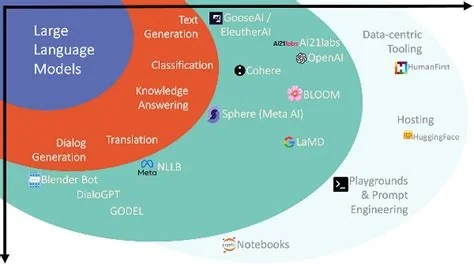

BigBear.ai has pursued several initiatives over the past six months, including:

- Acquisition of the analytics platform Ask Sage.

- Expansion into the Middle East market.

- Increased focus on national‑security contracts.

- Debt‑related actions aimed at strengthening the balance sheet.

These actions diversify revenue beyond traditional defense and intelligence customers and lay groundwork for broader commercial AI offerings.

Valuation Context and Market Position

The company’s market capitalization places it in the lower‑mid range of AI‑focused public firms, with valuation multiples modest relative to peers in the broader technology sector. Revenue growth remains driven by government contracts, while commercial AI solutions are still emerging.

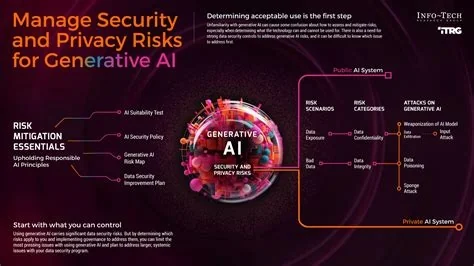

Risk Factors and Investor Considerations

Investors should weigh the following risks:

- Potential price correction if merger rumors remain unconfirmed.

- Competitive pressure in the commercial AI market.

- Debt levels that could limit future growth without a clear catalyst.

Conversely, a confirmed merger could provide scale, new technology assets, and expanded market access, enhancing the stock’s upside.

Market Sentiment and Future Outlook

The AI sector has experienced heightened speculative buying, with stocks moving sharply on partnership or consolidation news. As a result, sentiment can drive price swings more than earnings performance.

Monitoring official company communications and upcoming earnings releases will be crucial to determine whether the current rally is justified by financial performance or remains driven by speculation.

Bottom Line

BigBear.ai’s near‑100% share price surge appears largely fueled by merger speculation. While recent strategic initiatives provide a solid operational foundation, technical indicators and mixed analyst consensus suggest caution. Investors should stay alert to official merger confirmations and earnings results to gauge the sustainability of the rally.