AstraPad AI’s new KYC platform embeds real‑time identity verification into every seed and pre‑seed fundraising transaction, instantly matching vetted startups with qualified investors while handling compliance checks automatically. The solution eliminates manual paperwork, cuts deal latency, and ensures secure capital flow, giving founders a faster path to funding and investors a cleaner pipeline of qualified opportunities.

Why KYC Matters for Startup Fundraising

Regulatory frameworks across major markets require thorough Know‑Your‑Customer and anti‑money‑laundering checks before capital can be transferred. These compliance steps often become bottlenecks, delaying rounds and increasing legal costs. Automating KYC removes friction, protects both parties from fraud, and builds trust in the investment ecosystem.

Regulatory Pressure Drives Need for Automation

- Mandatory identity verification for cross‑border investments.

- Increasing scrutiny on anti‑money‑laundering compliance.

- Higher penalties for non‑compliant transactions.

How AstraPad AI’s Platform Works

Real‑Time Verification Engine

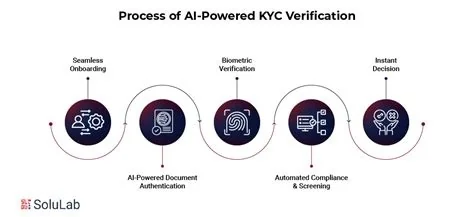

The proprietary engine validates the identities of founders and investors instantly, using encrypted data sources and multi‑factor authentication. Once verified, profiles are marked as compliant and ready for matchmaking.

Automated Investor Matchmaking

Verified startup profiles are algorithmically paired with investors whose investment focus aligns with the startup’s sector, stage, and technology stack. The system surfaces only those opportunities that have cleared compliance, streamlining outreach and reducing wasted effort.

Benefits for Founders

- Faster access to capital: Eliminate weeks of manual KYC paperwork.

- Focused pitching: Reach investors pre‑qualified for your sector.

- Reduced administrative burden: Spend more time on product development.

Benefits for Investors

- Higher‑quality pipeline: Receive only vetted startups ready for due diligence.

- Time savings: Skip preliminary identity checks and move straight to strategic evaluation.

- Immediate decision‑maker contacts: Access verified founder and executive details instantly.

Market Impact and Future Outlook

By combining compliance automation with intelligent matchmaking, AstraPad AI sets a new benchmark for fundraising platforms. As capital continues to flow into AI, SaaS, and Web3 sectors, tools that reduce friction will become essential infrastructure for the next generation of tech startups. The platform’s scalability could reshape how early‑stage companies secure funding and how investors discover high‑potential ventures.