The AI venture capital market has poured roughly $3.5 billion into five mega‑deals, each exceeding $100 million, marking a rapid acceleration of funding for both pure‑play AI platforms and hybrid solutions that blend artificial intelligence with physical applications. This surge signals strong investor confidence and sets the stage for accelerated model development, infrastructure expansion, and cross‑domain innovation.

Top Five AI Funding Rounds

- Skild AI – Pittsburgh, PA – Scalable foundation models for robotics and embodied AI – ≈ $1.4 B – Undisclosed round

- ClickHouse – San Francisco, CA – Real‑time analytics, data warehousing, AI infrastructure – $400 M – Series D

- Parloa – Berlin, Germany – AI agents for enterprise customer‑experience automation – $350 M – Series D (valuation $3 B)

- DC BLOX – Atlanta, GA – Connected data‑center and fiber‑network infrastructure for digital transformation – $240 M – HoldCo financing

- Tulip – Somerville, MA – No‑code frontline‑operations platform for manufacturers and logistics firms – $120 M – Series D

Parallel Mega Rounds in the United States

- Zipline – Drone‑delivery unicorn – $600 M Series C – Valuation $7.6 B

- Humans& – AI research lab founded by former engineers of leading AI firms – $480 M seed round

- Baseten – AI infrastructure – $300 M Series B – Valuation $5 B

- OpenEvidence – Medical AI – $250 M Series D – Valuation $12 B

- Noveon Magnetics – Rare‑earth magnet manufacturing – $215 M Series C

- Upscale AI – AI networking infrastructure – $200 M Series A

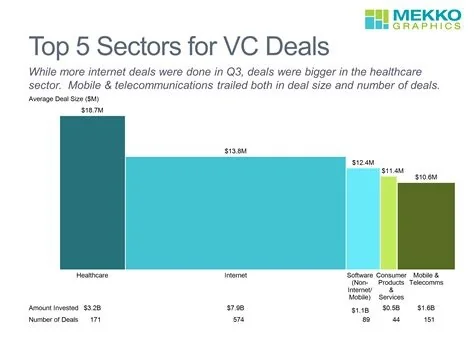

Market Concentration of Mega Rounds

Recent analysis shows that a majority of global venture capital is gravitating toward deals larger than $100 million, reinforcing the capital‑intensive nature of large‑model training and the strategic importance of AI across industries. Leading investors are targeting AI startups at every stage, from seed to growth, fueling both established players and ambitious newcomers.

Implications for the AI Landscape

Accelerated Model Development

Massive capital injections, such as Skild AI’s $1.4 B raise, intensify competition to build general‑purpose embodied AI models, potentially reshaping manufacturing, logistics, and beyond.

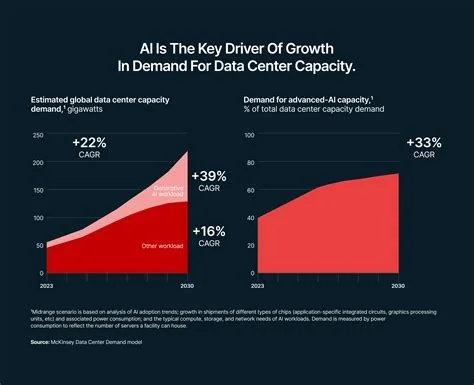

Infrastructure Bottlenecks Addressed

Funding for ClickHouse, DC BLOX, and Upscale AI highlights a focus on expanding data pipelines, networking capacity, and LLM observability, lowering barriers for smaller firms to adopt advanced models.

Cross‑Domain Innovation

Investments in drone delivery and rare‑earth magnets illustrate AI’s expanding role in physical‑world solutions, from autonomous logistics to advanced materials.

Valuation Pressure and Market Discipline

The prevalence of $100 million‑plus rounds can inflate valuations; startups will need clear revenue pathways to justify high post‑money figures.

Geographic Diversification

Strong funding activity across both Europe and the United States suggests a more distributed AI innovation map, fostering cross‑border collaboration and talent flow.

Looking Ahead

If current trends continue, AI could transition from a high‑growth niche to a foundational layer of the global economy. Investors appear ready to fund both compute‑heavy model builders and the ancillary infrastructure needed for large‑scale deployment. Aligning product roadmaps with emerging infrastructure priorities—such as model observability, unified data stacks, and real‑world AI applications—may be essential for startups seeking a share of the multi‑billion‑dollar AI market.